2024-05-14

Target

$ 1 Billion

Deal Size

Buyer

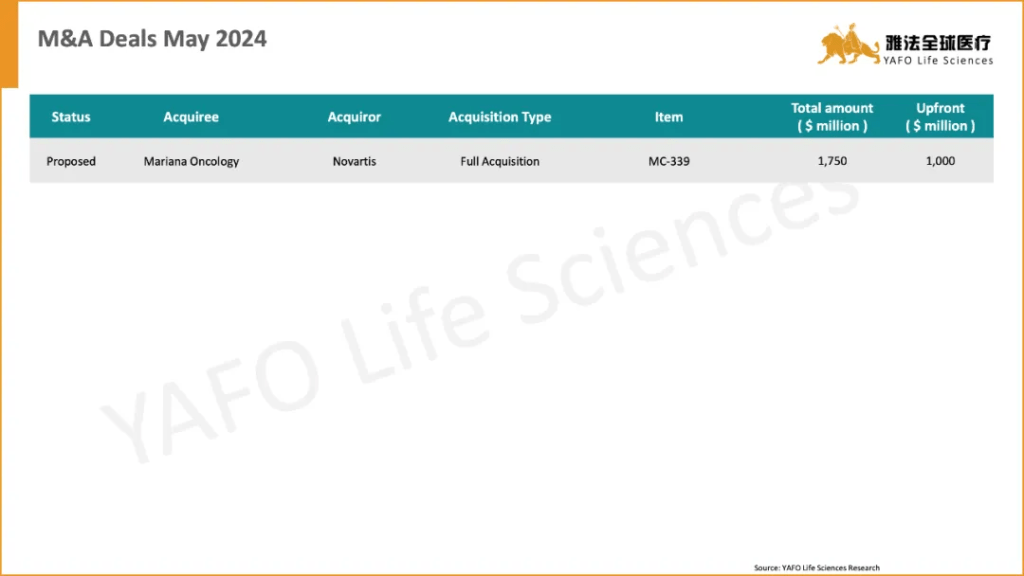

On May 2, Novartis announced the acquisition of Mariana Oncology, an innovative radiopharmaceutical company, for $1 billion, further consolidating its current position as the global leader in radiopharmaceutical field. Earlier this week, Novartis also announced an agreement with PeptiDream to collaborate on the development of a cyclic peptide RDC drug.

Novartis already has two approved radiopharmaceutical products, Lutathera and Pluvicto, which contributed nearly $500 million in sales in the first quarter of 2024.

According to the transaction information disclosed, the two parties began contact at the JPM conference in January this year. Mariana Oncology raised $175 million just last year, valuing it at about $300 million, and the investors made a significant profit on the deal. Mariana currently mainly targets a variety of solid tumors through the combination of peptides and alpha-emitting radionuclide. The company has well-equipped upstream and downstream production facility. Its leading asset MC-339 is expected to submit IND for the treatment of lung cancer this year.

This transaction has furtherly driven the already hot radiopharmaceutical field, and greatly raised the future transaction expectations. There is an increasing asset-heavy trend in the radiopharmaceutical field, and Chinese companies will have more opportunities to participate.

Peter Zhang

Partner, YAFO Capital

Target

$ 1 Billion

Deal Size

Buyer

5月2日,诺华宣布以10亿美金收购核药创新药企Mariana Oncology, 进一步巩固了自己目前全球核药龙头的地位。本周早些时候,诺华还宣布了与PeptiDream达成合作开发环肽RDC药物的协议。

目前诺华已经有两款核药在进行商业化销售,分别是Lutathera 和Pluvicto, 两款药物在2024年第一季度贡献了接近5亿美金的销售额。

根据与Mariana交易披露的信息,双方在今年1月的JPM大会开始接触。Mariana Oncology在去年刚进行了1.75亿美元的融资,当时的估值约为3亿美金,投资人在该交易的收益非常可观。Mariana目前主要通过多肽与Alpha射线核药联合治疗多种实体瘤。公司拥有非常完善的上下游生产设备。目前公司的主要资产MC-339预计今年提交IND,用于肺癌的治疗。

本交易进一步带动了本已经火热的核药赛道,极大提升了未来的交易预期。核药领域有着非常大的重资产趋势,中国企业将会有更多的机会参与其中。

Peter Zhang

Partner, YAFO Capital

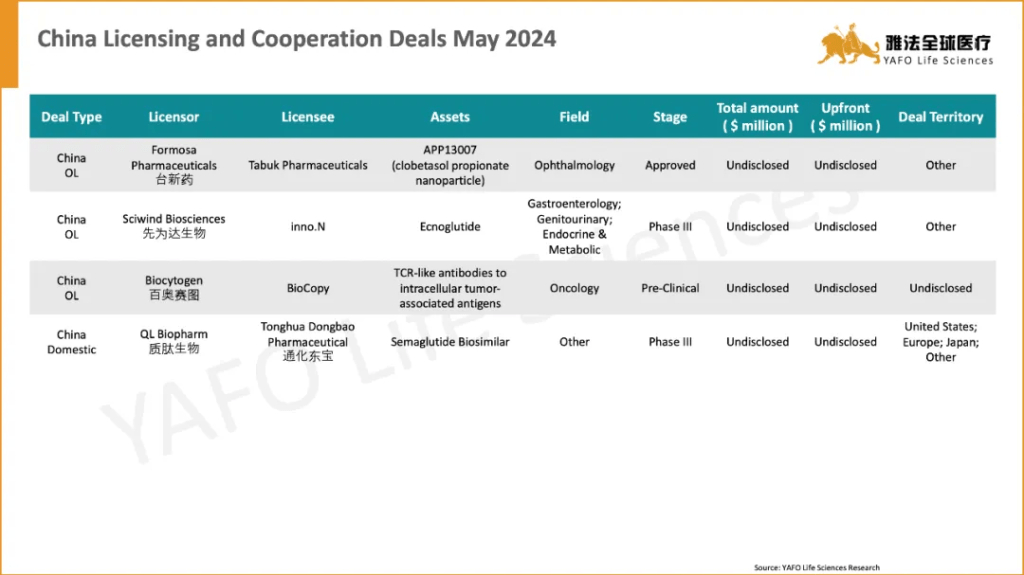

1. Summary of the week

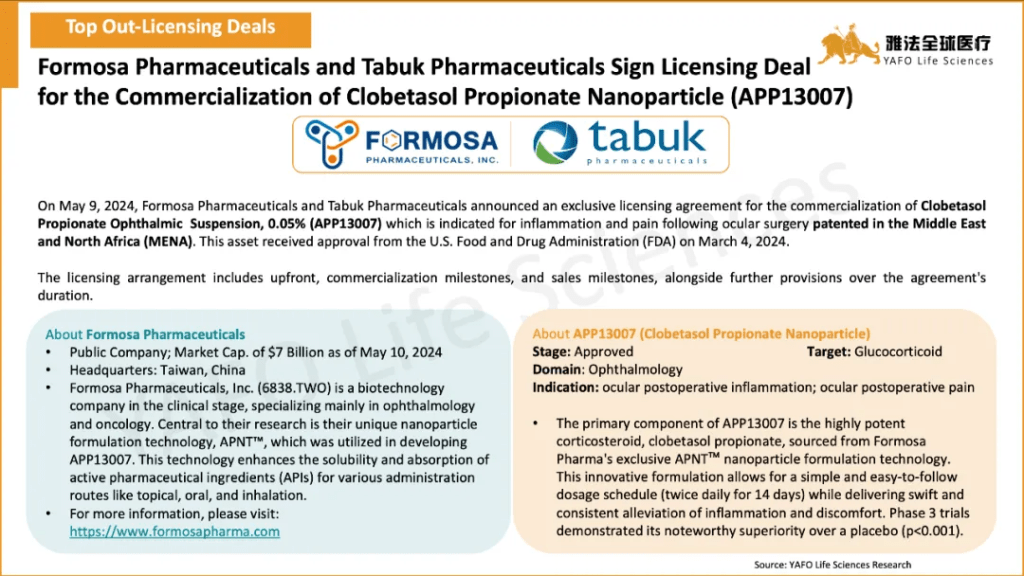

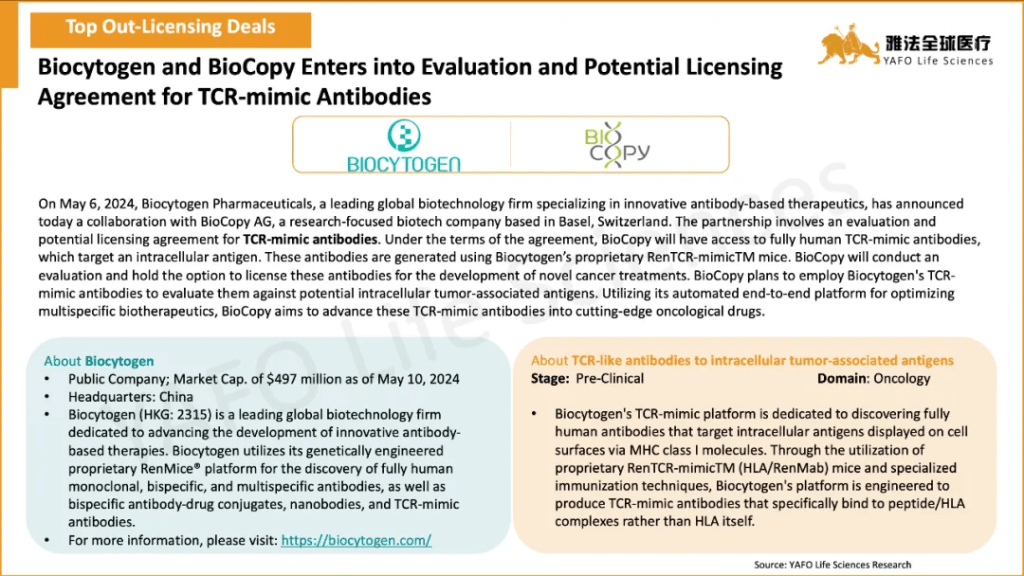

From May 1 to May 10, a total of 18 licensing and cooperation deals were signed globally. Specifically, in the China Biotech Industry, there were 3 out-licensing deals and 1 domestic deal, while two of them are related with GLP-1 agonists. Sciwind Biosciences and inno.N signed a cooperation and licensing deal for Ecnoglutide. And, domestically, QL Biopharm and Tonghua DongbaoPharmaceutical sealed a licensing and cooperation agreement for SemaglutideBiosimilar.

Globally, a total of 14 licensing and cooperation deals were signed. The licensing and cooperation deal between Poseida Therapeutics and Astellas topped this week with a total deal amount of $550 million and an upfront payment of $50 million. Another deal highlight of the week is the cooperation deal between Metaphore Biotechnologies, Flagship Pioneering, and Novo Nordisk for MIMIC platform with the total deal amount of $600 million.

2024年5月1日-10日,全球医药市场共签署了18笔资产授权和合作协议。其中,中国医药市场共达成4笔交易,包括3笔出海交易和1笔国内交易。其中有2笔交易均与GLP-1激动剂相关,先为达生物与韩国HK inno.N Corpora就Ecnoglutide的韩国权益达成许可和合作协议,以及通化东宝与北京质肽生物就司美格鲁肽仿制药达成商业化授权及合作协议。

2. Licensing Deals

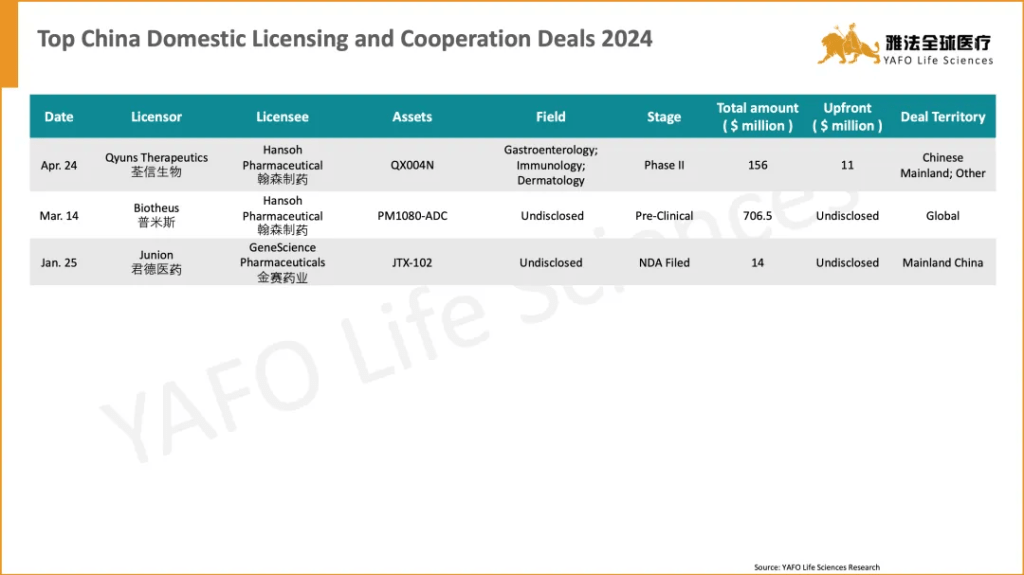

2a. China section

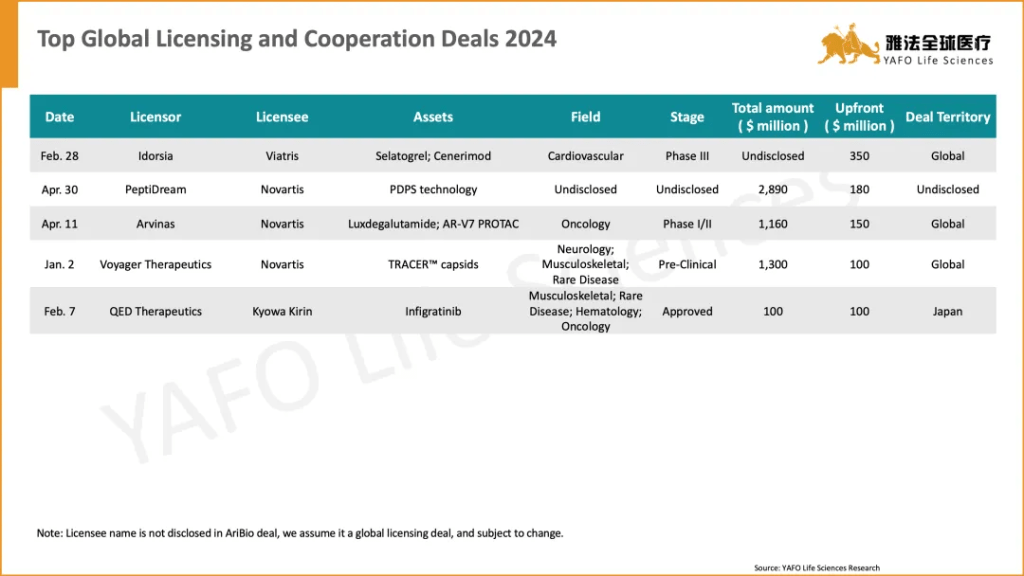

2b. Global section

3.M&A Deals

4. Top Deals of the year 2024

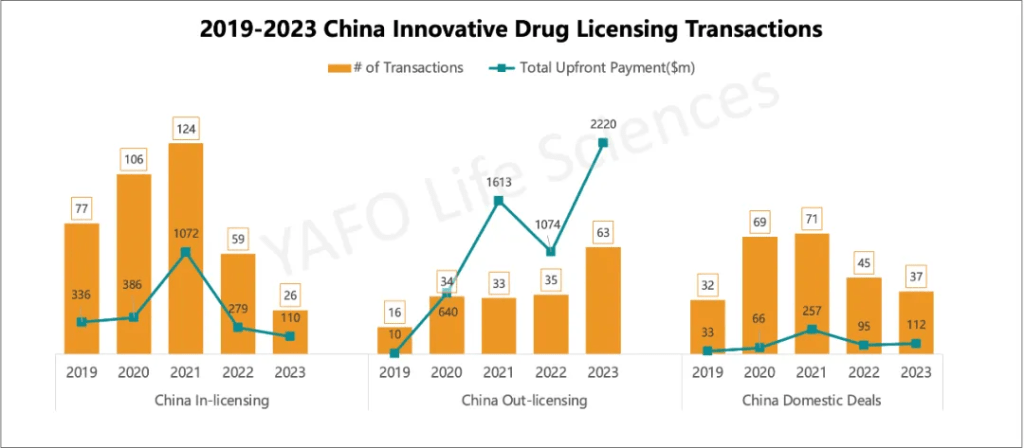

5. 2019-2023 China Innovative Drug Licensing Transactions

About YAFO Capital

雅法资本成立于2013年,作为新型投资和投行咨询机构,致力于中国及海外生物医药项目的投资、融资服务、产品引进和资产孵化等。雅法在生物医药跨境授权及并购业务领域过往三年交易数量排名第一。旗下雅法基金联合药企进行资产投资和并购,雅法全球医疗专注于医药产品跨境及国内授权交易。基于雅法在全球广泛的人脉与资源网络,在过去十年成功推进了大量的海外项目进入中国市场并协助多个中国产品完成海外授权。雅法拥有经验丰富的全球交易团队,覆盖美国、日本 、欧洲等全球主要医药创新区域。核心合伙人均为华尔街资深投行人士或具有跨国药企经历,为客户交易提供强力支持。雅法总部位于上海,在伦敦、洛杉矶、东京、米兰、剑桥等地均设有分部。

Founded in 2013, YAFO Capital is a Shanghai based boutique investment and advisory firm, with professional team in our China, U.S., and London offices. Partnering with Pharmaceutical companies, YAFO Fund mainly invests in global assets. YAFO Life Sciences is a leading advisory boutique focused on asset transactions. YAFO has built a strong proven track record and closed dozens of in-licensing and out-licensing transactions with global pharma and biotech companies. YAFO has been ranked as the No. 1 advisor for China cross border licensing transactions in the past three years. For more information, please visit http://www.yafocapital.com

药通中国近期活动

ACCESS CHINA

Event Name: ACCESS CHINA Networking&Gathering @BIO

Date & Time: June 2-6, 2024

Venue: San Diego

Content: Reception, 1X1 meetings

Participants: Pharma/Biotech senior management and BDs.

Registration Link: https://jinshuju.net/f/AqkB9m?x_field_1=BIO