2024-7-30

Target

Deal Size

Buyer

On July 24th., Novartis signed a $3 billion-valued collaboration agreement with Dren Bio. Under the agreement, Novartis will pay an upfront payment of $150 million which includes a $25 million equity investment, and up to $2.85 billion in milestone payments. The two parties will work together through the clinical candidate selection phase, while Novartis will be responsible for further clinical development. Prior to this, Pfizer had entered into a smaller collaboration agreement with Dren Bio, paying an upfront payment of $25 million and potentially over $1 billion in milestone payments.

The core of this collaboration is Dren Bio’s bispecific antibody platform, which is mainly used to develop agonists targeting myeloid cells. Myeloid cells play a “referee” role in the immune system. By targeting myeloid cells, it is possible to more precisely regulate the immune system and avoid side effects on non-target cells. The candidate drugs developed by this platform may be safer and more effective than similar T-cell engager or antibody drugs.

Dren Bio’s main assets include a monoclonal antibody targeting CD94, which is currently undergoing a Phase 1/2 clinical trial for the treatment of rare forms of leukemia or cytotoxic lymphoma. Additionally, Dren Bio launched a clinical trial this month for DR-0201 to treat relapsed or refractory B-cell non-Hodgkin lymphoma. This Phase 1 trial plans to recruit approximately 50 patients in Asia and Australia.

Peter Zhang

Partner, YAFO Capital

Target

Deal Size

Buyer

7月24日,Novartis与Dren Bio签署了一项总价值30亿美元的合作。Novartis将支付1.5亿美元的预付款、其中包括2500万美元的股权投资,以及最高28.5亿美元的里程碑付款,双方将在临床候选药物选择阶段进行联合开发并由Novartis负责进一步的临床开发。在此之前,辉瑞公司与Dren Bio曾达成了一项较小的合作协议,支付了2500万美元的预付款和超过10亿美元的潜在里程碑付款。

Dren Bio的双特异性抗体平台是此次合作的核心,该平台主要用于开发针对髓系细胞的激动剂,髓系细胞在免疫系统中扮演着类似“裁判”的角色,通过靶向髓系细胞,可以更精确地调控免疫系统,避免对非目标细胞的副作用,其平台开发的候选药物可能比类似的T Cell Engager或抗体药物更安全有效。

Dren Bio的主要资产包括一款靶向CD94的单克隆抗体,目前正在进行的一项1/2期临床试验,该药用于治疗罕见形式的白血病或细胞毒性淋巴瘤。此外,Dren Bio本月启动了DR-0201治疗复发或难治性B细胞非霍奇金淋巴瘤的临床,该1期试验计划在亚洲和澳大利亚的招募约50名患者。

Peter Zhang

Partner, YAFO Capital

1. Summary of the week

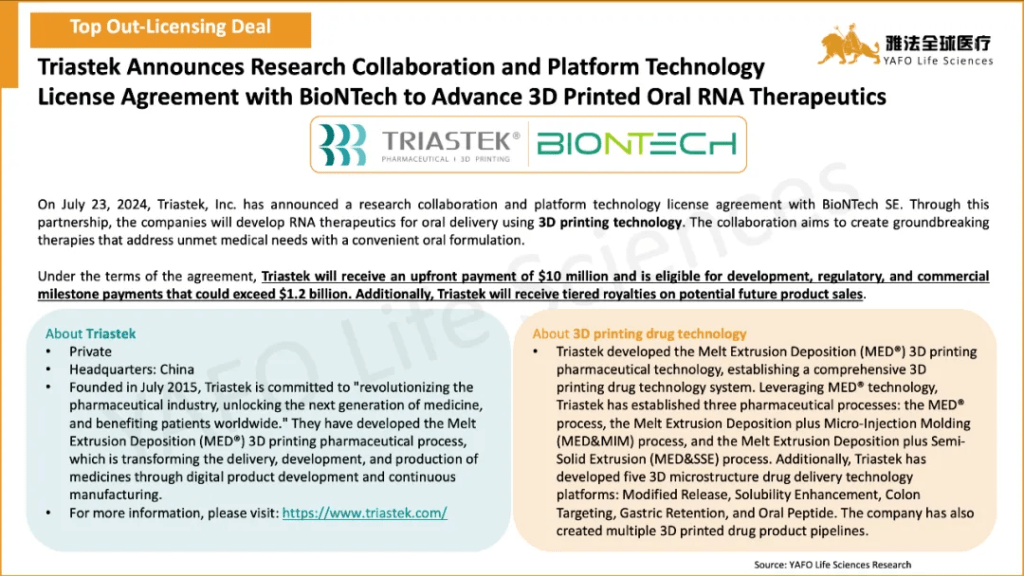

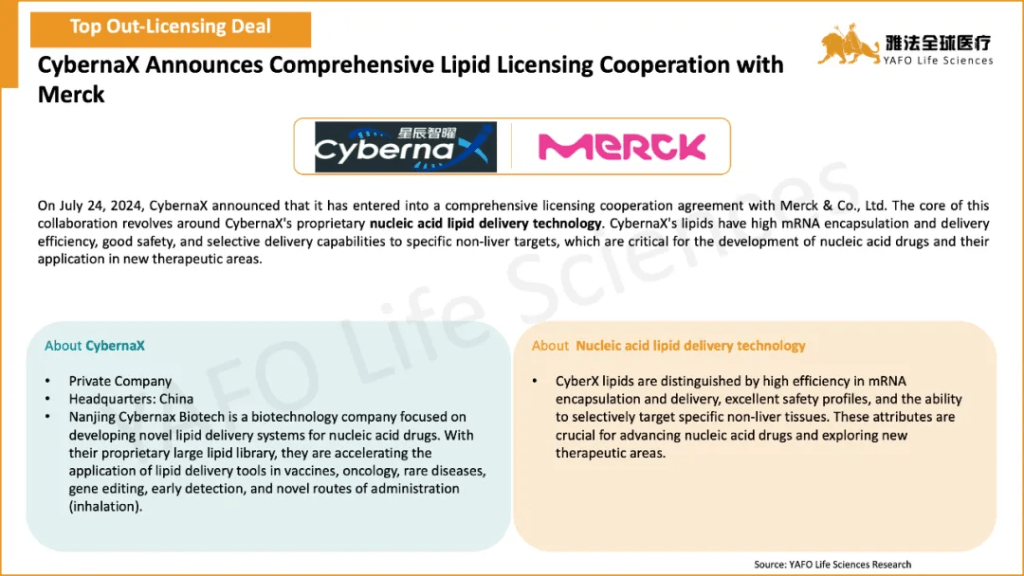

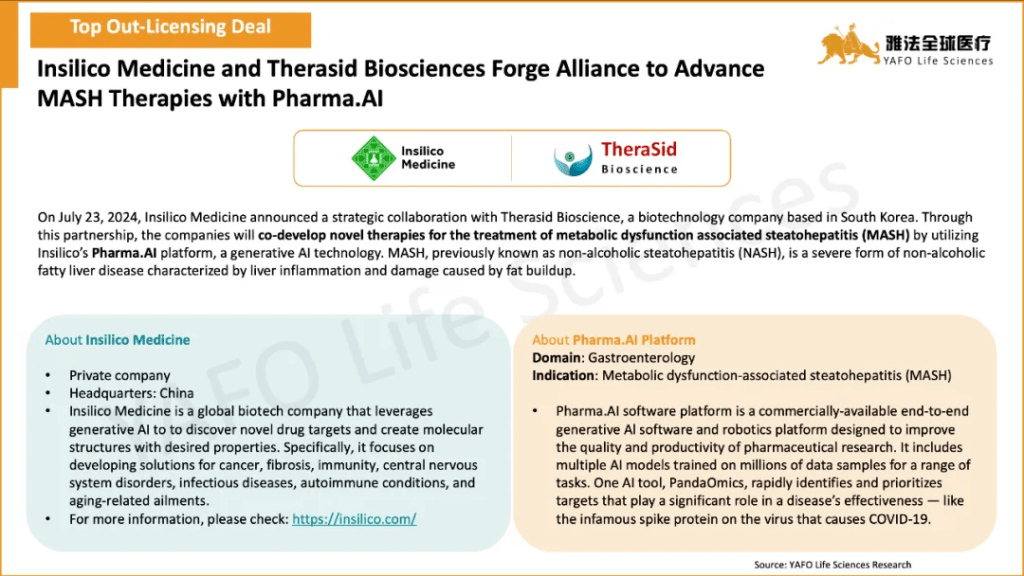

From July 19 to 26, a total of 13 licensing and cooperation deals were signed globally. In the Chinese biotech industry, there were 3 out-licensing deals and 1 domestic deal. Notably, Triastek and BioNTech signed a license agreement valued at $1.21 billion, including a $10 million upfront payment.

Globally, nine licensing and cooperation agreements were finalized. The highlight deal of the week was between Dren Bio and Novartis, involving bispecific antibodies, with a total value of $3 billion and an upfront payment of $150 million. Another significant deal was the license and investment agreement between Day One Biopharma and Ipsen for tovorafenib, totaling $461 million with an upfront payment of $111 million.

7月19日到26日,全球医药市场共签署了13项授权和合作协议。中国医药市场上,共签署了4项交易,包括3项对外授权协议和1项国内协议。值得关注的交易是三迭纪与BioNTech签署了一项价值12.1亿美元的授权协议,包括1000万美元的首付款。

在全球范围内,共有9项授权和合作协议最终确定。本周的亮点交易是Dren Bio与诺华之间达成双特异性抗体资产交易,总价值30亿美元,首付款1.5亿美元。另一项重要交易是Day One Biopharma与Ipsen就tovorafenib达成的授权和投资协议,总计4.61亿美元,首付款为1.11亿美元。

2. Licensing Deals

2a. China section

2b. Global section

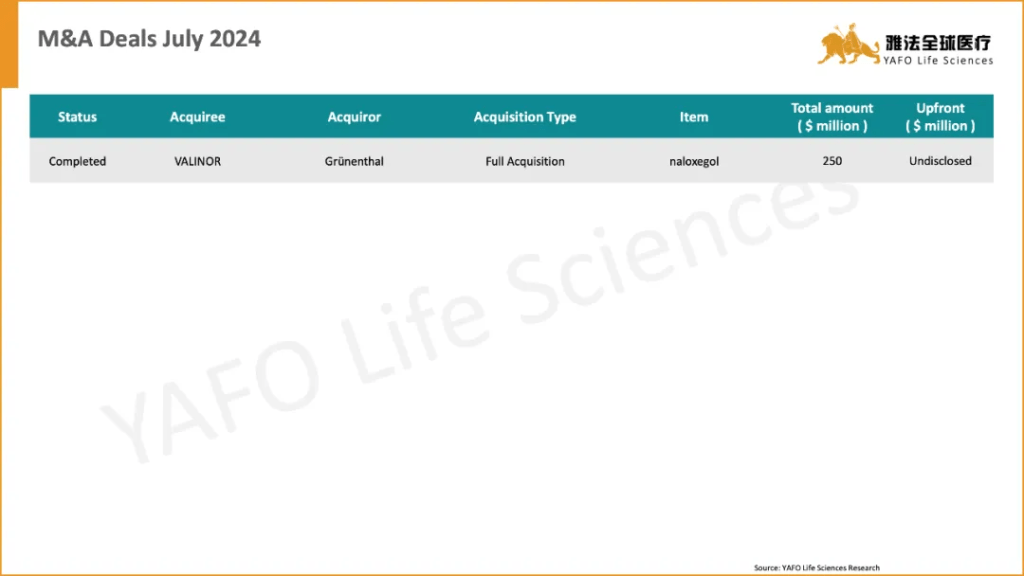

3. M&A Deals

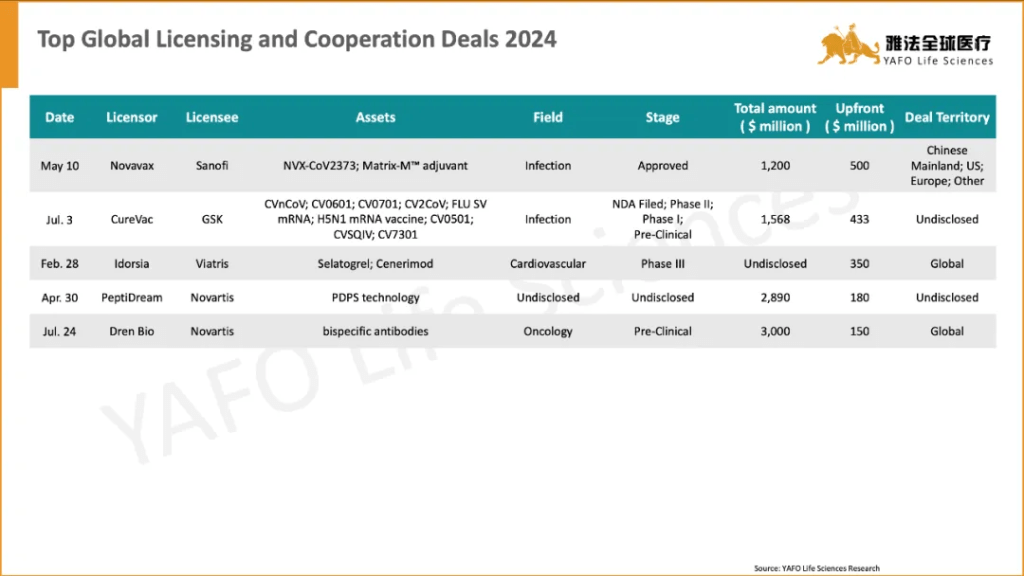

4. Top Deals of the year 2024

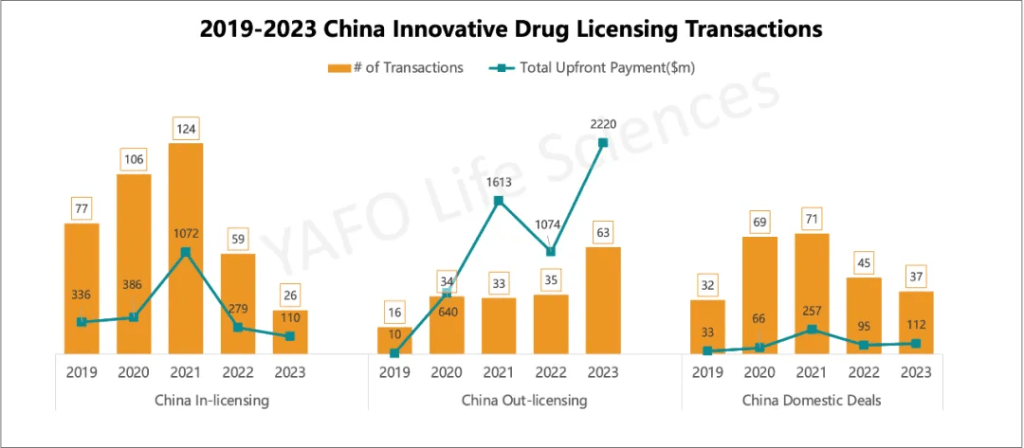

5. 2019-2023 China Innovative Drug Licensing Transactions

ABOUT YAFO CAPITAL

雅法资本成立于2013年,作为新型投资和投行咨询机构,致力于中国及海外生物医药项目的投融资、资产跨境交易和资产孵化等。旗下雅法基金联合药企进行资产投资和并购,雅法全球医疗专注于医药产品跨境及国内授权交易。基于雅法在全球广泛的人脉与资源网络,在过去十年成功推进了大量的海外项目进入中国市场并协助多个中国产品完成海外授权。雅法拥有经验丰富的全球交易团队,覆盖美国、日本 、欧洲等全球主要医药创新区域。核心合伙人均为华尔街资深投行人士或具有跨国药企经历,为客户交易提供强力支持。雅法总部位于上海,在美国、欧洲、东南亚等地均设有分部。雅法在生物医药跨境授权及并购业务交易数量连续多年排名第一。

Founded in 2013, YAFO Capital is a Shanghai based boutique investment and advisory firm, with professional team in our China, U.S., EU and SEA offices. Partnering with Pharmaceutical companies, YAFO Fund mainly invests in global assets. YAFO Life Sciences is a leading advisory boutique focused on asset transactions. YAFO has built a strong proven track record and closed dozens of in-licensing and out-licensing transactions with global pharma and biotech companies. Over the past five years, YAFO has been ranked as the No. 1 advisor for China cross border licensing transactions. For more information, please visit http://www.yafocapital.com

ACCESS CHINA

Event Name:

2024-09 药通中国秋季路演,线上&云南

2024-09 ACCESS CHINA Autumn Roadshow, Virtual & Yunnan

2025-01 药通中国论坛@JPM,线上&旧金山

2025-01 ACCESS CHINA @ JPM Week, Virtual & San Francisco