2024-08-01

1. Executive Summary of the Month

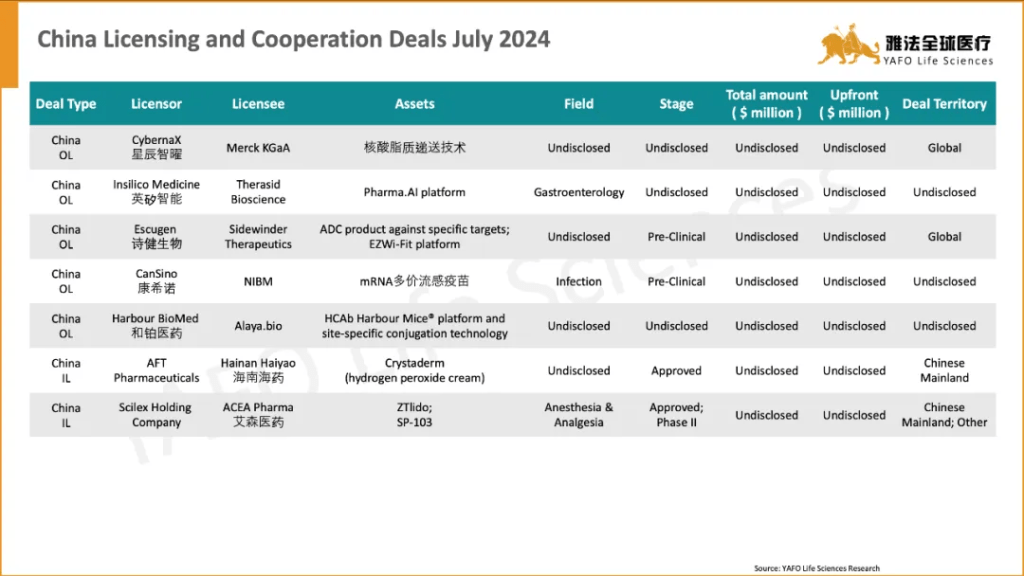

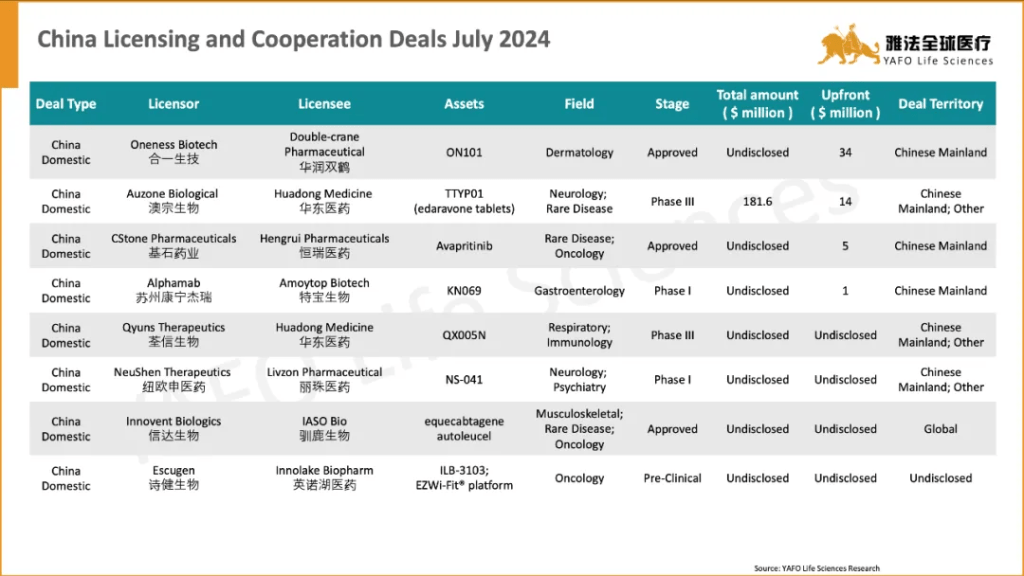

2024年7月,全球医药市场共签署了60项资产授权和合作协议。其中,中国医药市场达成22项交易,包括12项出海交易、8项国内交易和2项引进交易。

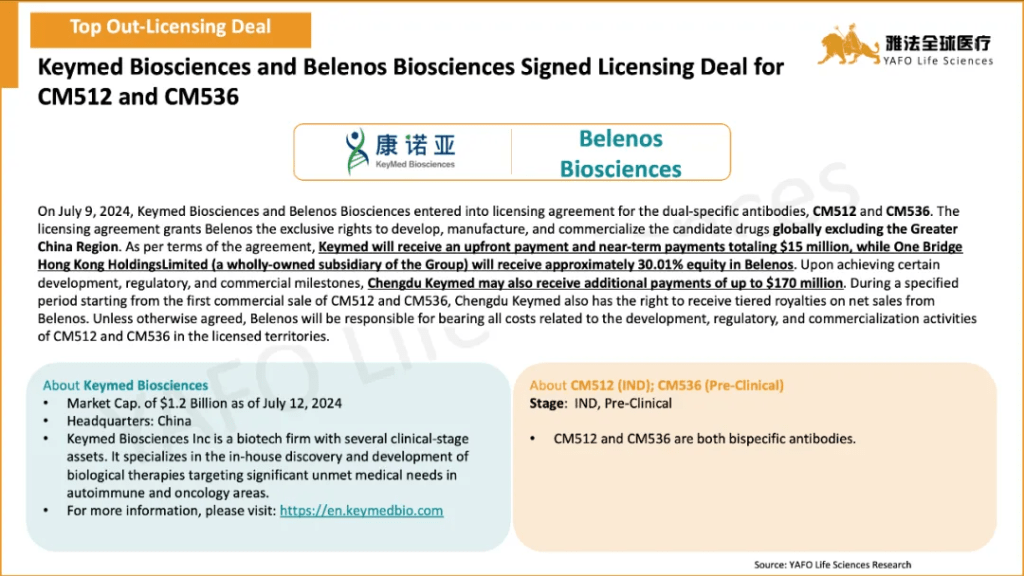

本月中国市场最值得关注的出海交易是康诺亚向Belenos Biosciences授权两款临床前双抗资产CM512和CM536,首付款1500万美元,总价值1.85亿美元。最值得关注的国内交易是合一生技就其已获批药物ON101与华润双鹤达成的的授权交易,首付款3400万美元。

国际市场上,7月份共签署了38项资产授权和合作协议。最大的一笔交易是GSK与CureVac之间就后者的多项疫苗资产达成的合作,首付款4.33亿美元,总金额15.68亿美元。

In July, a total of 60 licensing and cooperation deals were signed globally. Within the China Biotech Industry, 22 deals were signed, including 12 out-licensing deals, 2 in-licensing deals, and 8 domestic deals.

The standout out-licensing deal of the month was between Keymed Biosciences and Belenos Biosciences for the pre-clinical assets CM512 and CM536, totaling $185 million with an upfront payment of $15 million. The highlight domestic deal was the licensing agreement between Oneness Biotech and Double-crane Pharmaceutical for the approved asset ON101, featuring an upfront payment of $34 million.

Globally, 38 licensing and cooperation deals were finalized. The most significant was the agreement between CureVac and GSK for multiple vaccine assets, totaling $1,568 million with an upfront payment of $433 million.

Target

Deal Size

Buyer

On July 24th., Novartis signed a $3 billion-valued collaboration agreement with Dren Bio. Under the agreement, Novartis will pay an upfront payment of $150 million which includes a $25 million equity investment, and up to $2.85 billion in milestone payments. The two parties will work together through the clinical candidate selection phase, while Novartis will be responsible for further clinical development. Prior to this, Pfizer had entered into a smaller collaboration agreement with Dren Bio, paying an upfront payment of $25 million and potentially over $1 billion in milestone payments.

The core of this collaboration is Dren Bio’s bispecific antibody platform, which is mainly used to develop agonists targeting myeloid cells. Myeloid cells play a “referee” role in the immune system. By targeting myeloid cells, it is possible to more precisely regulate the immune system and avoid side effects on non-target cells. The candidate drugs developed by this platform may be safer and more effective than similar T-cell engager or antibody drugs.

Dren Bio’s main assets include a monoclonal antibody targeting CD94, which is currently undergoing a Phase 1/2 clinical trial for the treatment of rare forms of leukemia or cytotoxic lymphoma. Additionally, Dren Bio launched a clinical trial this month for DR-0201 to treat relapsed or refractory B-cell non-Hodgkin lymphoma. This Phase 1 trial plans to recruit approximately 50 patients in Asia and Australia.

Peter Zhang

Partner, YAFO Capital

Target

Deal Size

Buyer

7月24日,Novartis与Dren Bio签署了一项总价值30亿美元的合作。Novartis将支付1.5亿美元的预付款、其中包括2500万美元的股权投资,以及最高28.5亿美元的里程碑付款,双方将在临床候选药物选择阶段进行联合开发并由Novartis负责进一步的临床开发。在此之前,辉瑞公司与Dren Bio曾达成了一项较小的合作协议,支付了2500万美元的预付款和超过10亿美元的潜在里程碑付款。

Dren Bio的双特异性抗体平台是此次合作的核心,该平台主要用于开发针对髓系细胞的激动剂,髓系细胞在免疫系统中扮演着类似“裁判”的角色,通过靶向髓系细胞,可以更精确地调控免疫系统,避免对非目标细胞的副作用,其平台开发的候选药物可能比类似的T Cell Engager或抗体药物更安全有效。

Dren Bio的主要资产包括一款靶向CD94的单克隆抗体,目前正在进行的一项1/2期临床试验,该药用于治疗罕见形式的白血病或细胞毒性淋巴瘤。此外,Dren Bio本月启动了DR-0201治疗复发或难治性B细胞非霍奇金淋巴瘤的临床,该1期试验计划在亚洲和澳大利亚的招募约50名患者。

Peter Zhang

Partner, YAFO Capital

Target

Deal Size

Buyer

On July 16th., Vertex Pharmaceuticals reached a collaboration agreement with Orum Therapeutics, with a total value potentially exceeding $945 million, to co-develop DAC assets. Vertex will make an upfront payment of $15 million to Orum and provide milestone payments of up to $310 million per project for three projects.

Orum’s “Dual Precision Targeted Protein Degradation” (TPD²) technology will play a crucial role in this collaboration. This technology combines the targeting precision of antibodies with the potency of small molecule protein degraders to develop DACs. DACs combine the advantages of antibody drugs and protein degraders. Through antibody-mediated targeted delivery, DACs can significantly increase the potency of protein degraders, making them more effective in killing target cells. The degraders in DACs are inactive before being internalized by target cells, significantly reducing toxicity and side effects on non-target cells. Additionally, conjugating the degrader to an antibody can extend its half-life and increase drug exposure time, thus improving therapeutic efficacy.

In this collaboration, Vertex will be responsible for all research, development, and commercialization activities. The DACs developed will be used as conditioning agents, potentially replacing chemotherapy currently used to patients prepared for gene therapy.

In recent years, many biopharmaceutical companies have also been actively exploring and investing in DAC technology. For example, Bristol-Myers Squibb partnered with Orum last year to develop ORM-6151, a DAC used to treat acute myeloid leukemia (AML) and high-risk myelodysplastic syndromes (MDS). ORM-6151 combines an anti-CD33 antibody with a GSPT1 degrader, achieving efficient cancer cell killing through a dual-targeting mechanism.

Peter Zhang

Partner, YAFO Capital

Target

Deal Size

Buyer

7月16日,Vertex制药公司与Orum Therapeutics达成了一项总价值可能超过9.45亿美元的DAC资产联合开发交易。Vertex将向Orum支付1500万美元的预付款以及三个项目、每个项目最高可达3.1亿美元的里程碑付款。

Orum的“双精度靶向蛋白质降解”(TPD²)技术将在此次合作中发挥核心作用。这项技术通过将抗体的靶向精度与小分子蛋白质降解剂的效力结合,开发针对癌细胞和其他特定治疗的DACs。DAC结合了抗体药物和蛋白质降解剂的双重优势。通过抗体介导的靶向递送,DACs能够提高蛋白质降解剂效力,从而更有效地杀死目标细胞。DACs中的降解剂在被目标细胞内化之前是非活性的,这显著降低了对非目标细胞的毒性和副作用;同时,降解剂与抗体偶联可以延长其半衰期,增加药物暴露时间,从而提高治疗效果。

在此次合作中,Vertex将负责所有的研究、开发和商业化活动。开发出的DACs将用于预处理剂,可能取代目前用于准备基因治疗患者的化疗。

近年来,多家生物制药公司也在积极探索和投资DAC技术。例如, Bristol-Myers Squibb就在去年与Orum就其ORM-6151,一种用于治疗急性髓性白血病(AML)和高危骨髓增生异常综合症(MDS)的DAC开展合作。ORM-6151结合了抗CD33抗体和GSPT1降解剂,通过双重靶向机制实现对癌细胞的高效杀伤。

Peter Zhang

Partner, YAFO Capital

Target

Deal Size

Buyer

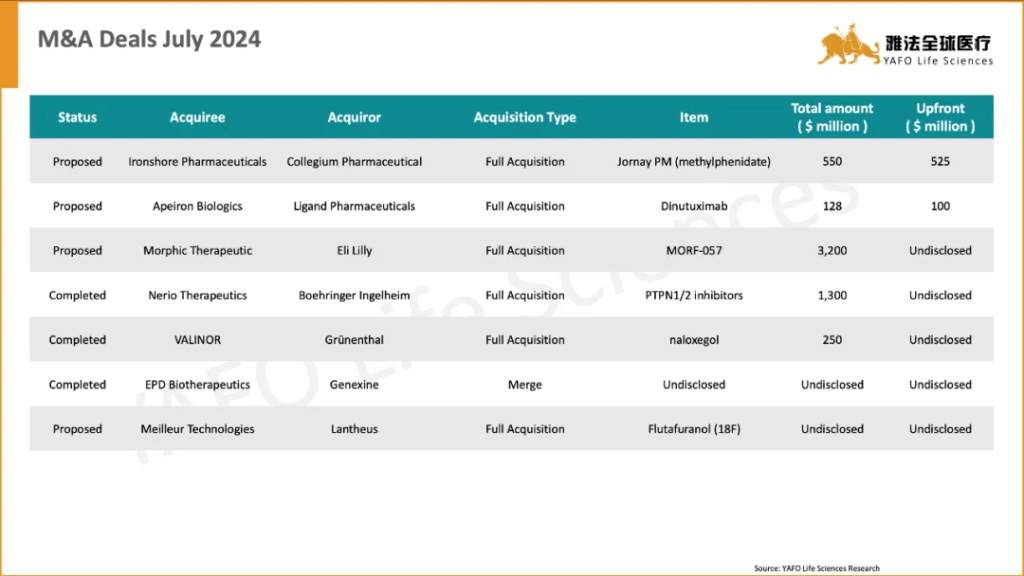

On July 8th, pharmaceutical giant Eli Lilly announced its acquisition of biotechnology company Morphic Therapeutic for $3.2 billion in cash, drawing widespread attention. The acquisition comes with a 79% premium and is expected to be completed in the third quarter of 2024. Lilly’s main goal in this acquisition is to obtain MORF-057, an oral α4β7 integrin inhibitor being developed by Morphic, signaling a further deepening of the company’s strategic positioning in the inflammatory bowel disease (IBD) treatment field.

α4β7 integrin is a key target for IBD treatment. Takeda’s Entyvio (vedolizumab), an intravenous α4β7 integrin inhibitor, is approved for the treatment of ulcerative colitis and Crohn’s disease and is currently leading the market. However, with the development of next-generation products, especially with oral formulations, the competitive landscape in this field is changing.

The emergence of oral formulations in the IBD market can improve patient compliance, becoming a key advantage for Lilly and other companies developing oral drugs. Also, α4β7 integrin inhibitors face potential threats from other emerging treatments, such as αEβ7 and TL1A inhibitors.

Peter Zhang

Partner, YAFO Capital

Target

Deal Size

Buyer

7月8日,制药巨头礼来宣布以32亿美元现金收购生物技术公司Morphic Therapeutic,引起广泛关注。此次收购溢价高达79%,预计将于2024年第三季度完成。礼来此举的主要目标在于获得Morphic正在开发的口服α4β7整合素抑制剂MORF-057,这标志着公司在炎症性肠病治疗领域的战略布局进一步深化。

α4β7整合素是炎症性肠病治疗的关键靶点。武田制药的Entyvio(vedolizumab)作为静脉注射给药的α4β7整合素抑制剂,已获批用于治疗溃疡性结肠炎和克罗恩病,在市场上占据领先地位。然而,随着新一代产品的研发,特别是口服制剂的出现,这一领域的竞争格局正在发生变化。

口服形式给药可以提高患者的依从性,成为礼来和其他开发口服制剂公司的关键优势。α4β7整合素抑制剂还面临其他潜在威胁。如αEβ7以及TL1A抑制剂,也正在崭露头角。

Peter Zhang

Partner, YAFO Capital

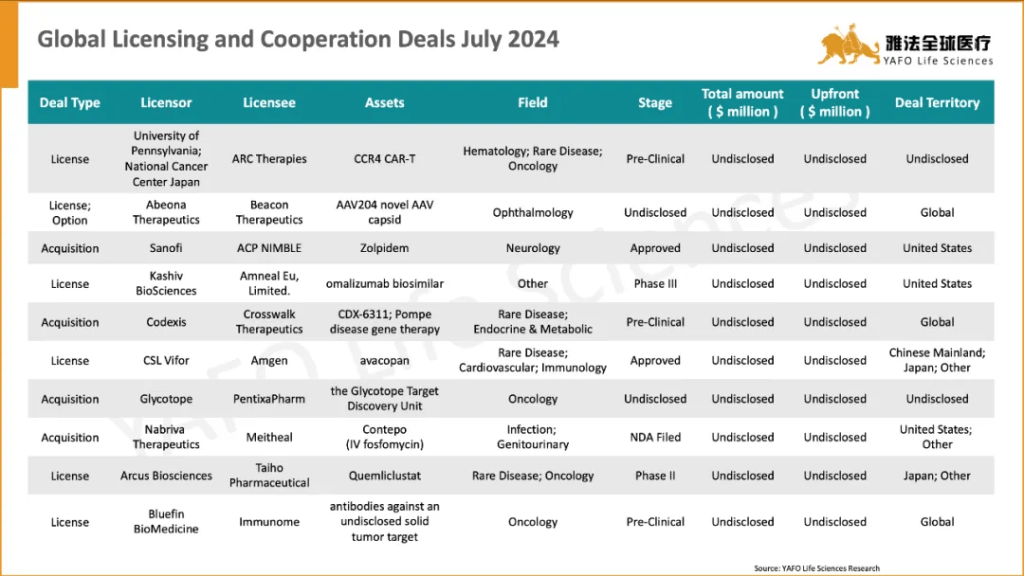

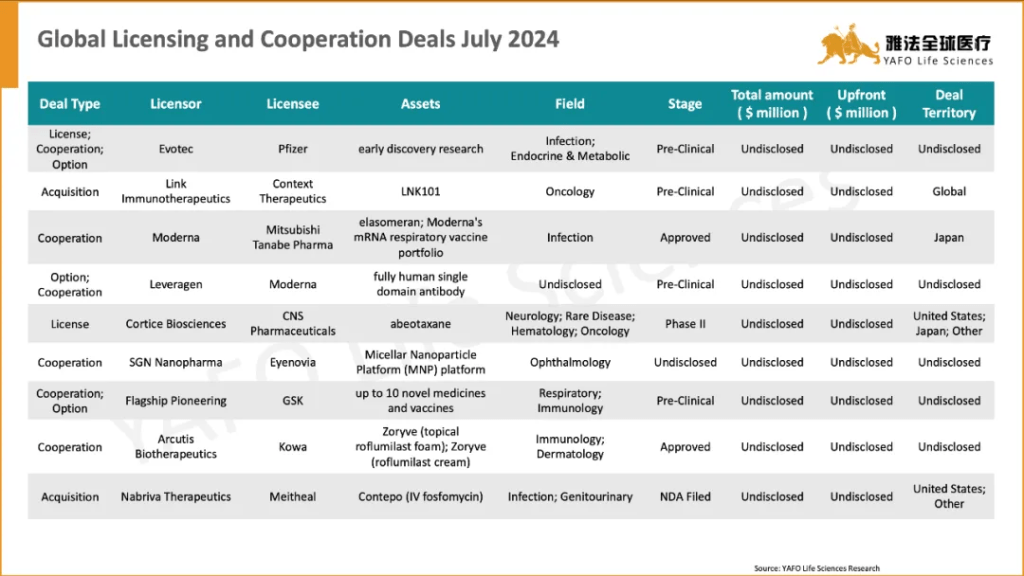

2. Licensing Deals

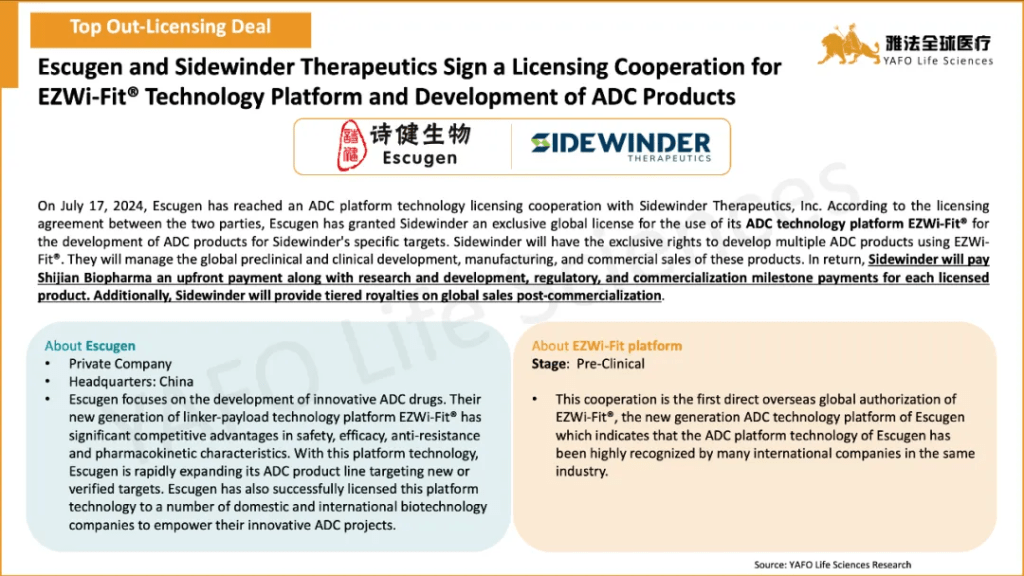

2a. Out-Licensing Deals

2b. In-Licensing Deals

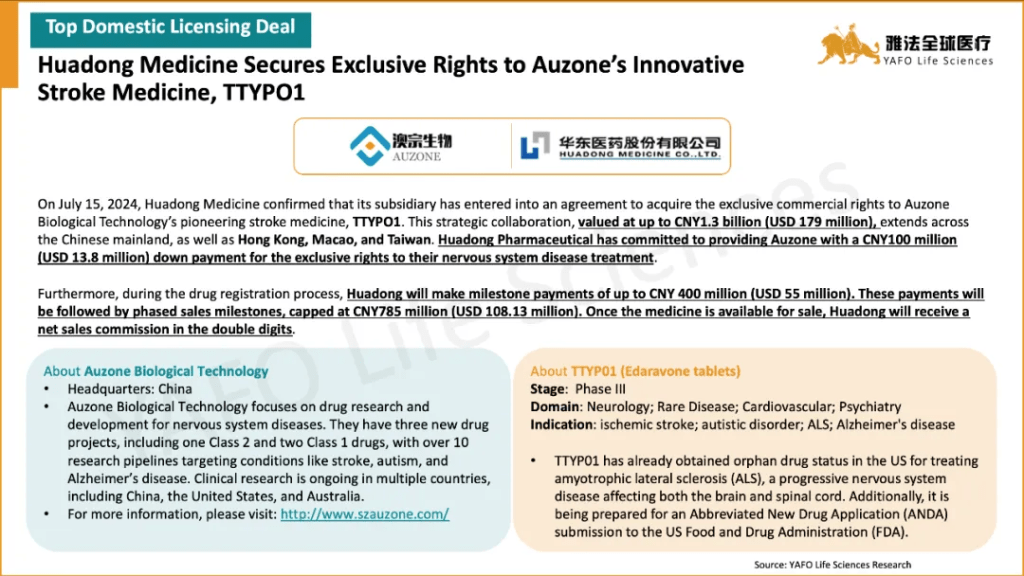

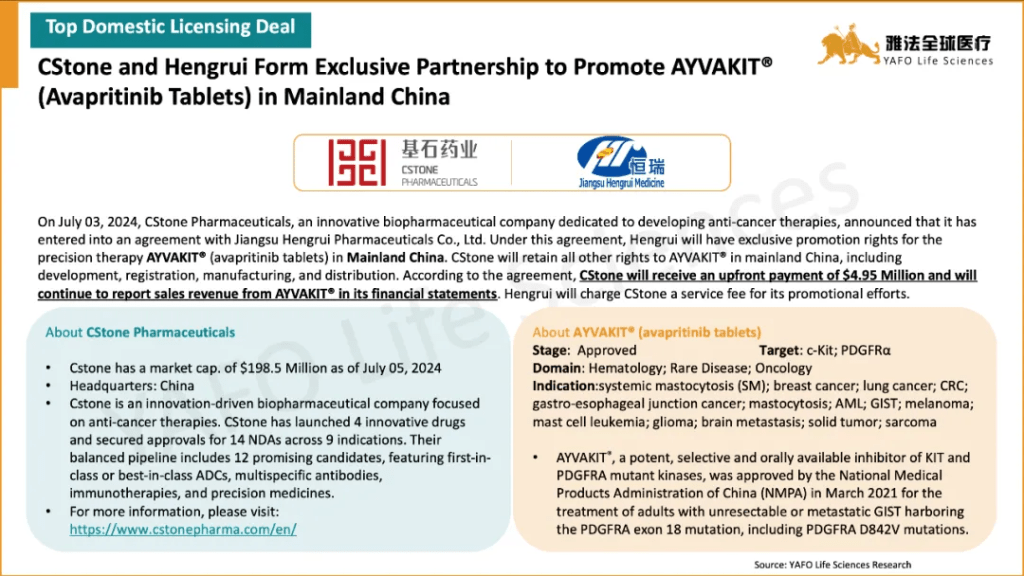

2c. Domestic Licensing Deals

3. 2019-2023 China Innovative Drug Licensing Transactions

About YAFO Capital

雅法资本成立于2013年,作为新型投资和投行咨询机构,致力于中国及海外生物医药项目的投融资、资产跨境交易和资产孵化等。旗下雅法基金联合药企进行资产投资和并购,雅法全球医疗专注于医药产品跨境及国内授权交易。基于雅法在全球广泛的人脉与资源网络,在过去十年成功推进了大量的海外项目进入中国市场并协助多个中国产品完成海外授权。雅法拥有经验丰富的全球交易团队,覆盖美国、日本 、欧洲等全球主要医药创新区域。核心合伙人均为华尔街资深投行人士或具有跨国药企经历,为客户交易提供强力支持。雅法总部位于上海,在美国、欧洲、东南亚等地均设有分部。雅法在生物医药跨境授权及并购业务交易数量连续多年排名第一。

About YAFO Capital

Founded in 2013, YAFO Capital is a Shanghai based boutique investment and advisory firm, with professional team in our China, U.S., EU and SEA offices. Partnering with Pharmaceutical companies, YAFO Fund mainly invests in global assets. YAFO Life Sciences is a leading advisory boutique focused on asset transactions. YAFO has built a strong proven track record and closed dozens of in-licensing and out-licensing transactions with global pharma and biotech companies. Over the past five years, YAFO has been ranked as the No. 1 advisor for China cross border licensing transactions. For more information, please visit http://www.yafocapital.com

ACCESS CHINA

Event Name:

2024-09 药通中国秋季路演,线上&云南

2024-09 ACCESS CHINA Autumn Roadshow, Virtual & Yunnan

2025-01 药通中国论坛@JPM,线上&旧金山

2025-01 ACCESS CHINA @ JPM Week, Virtual & San Francisco