2025-01-13

1. Summary of the Week

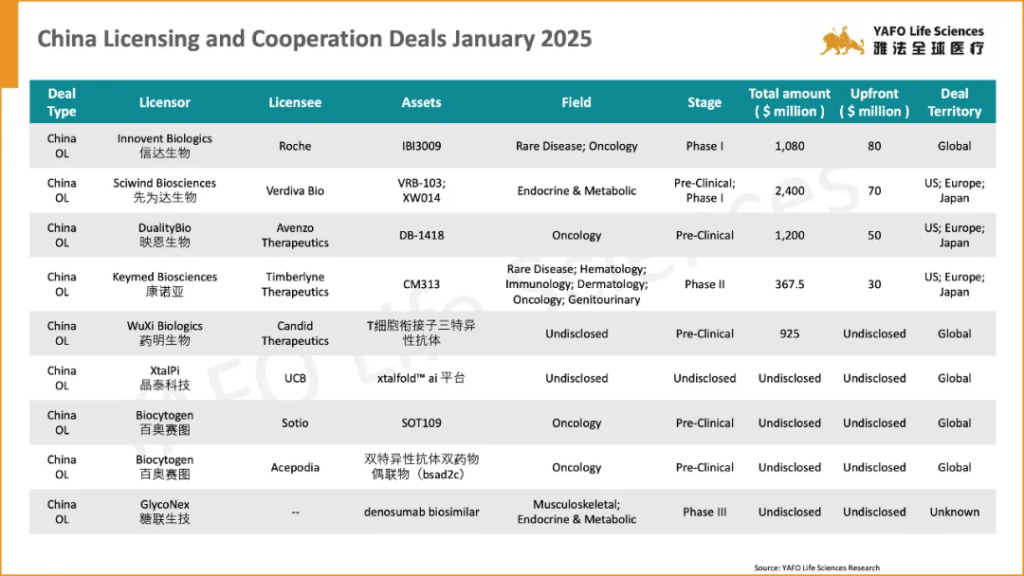

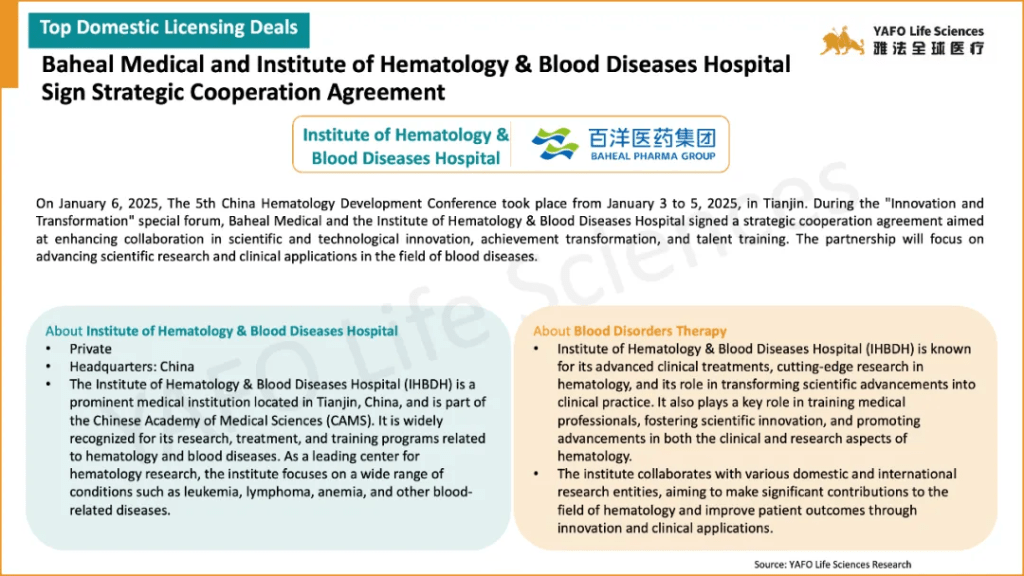

In the first week of January 2025, a total of 37 licensing and cooperation deals were signed worldwide. Within China’s biotech industry, there were 9 out-licensing deals, 3 in-licensing deals, and 4 domestic deals.

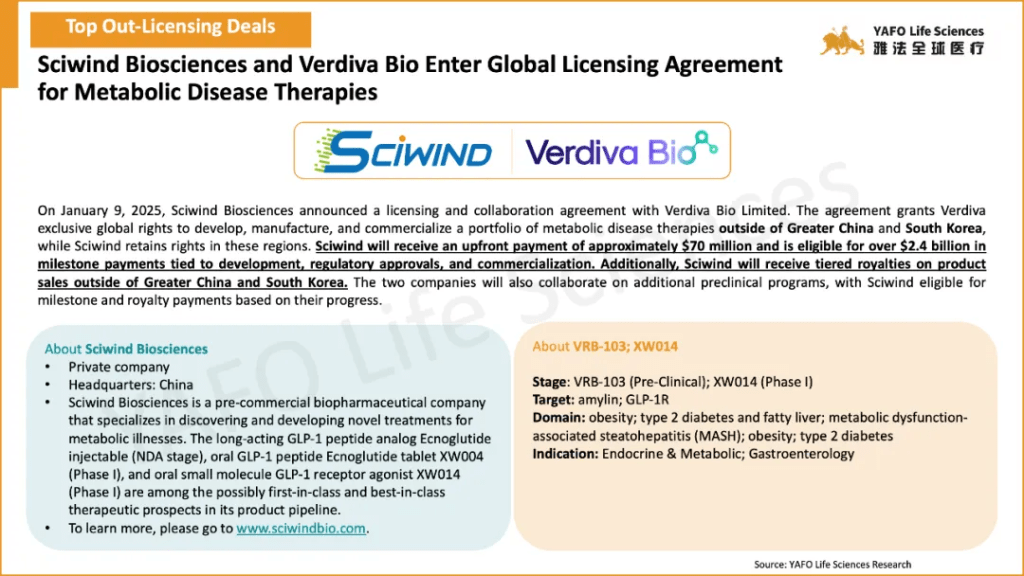

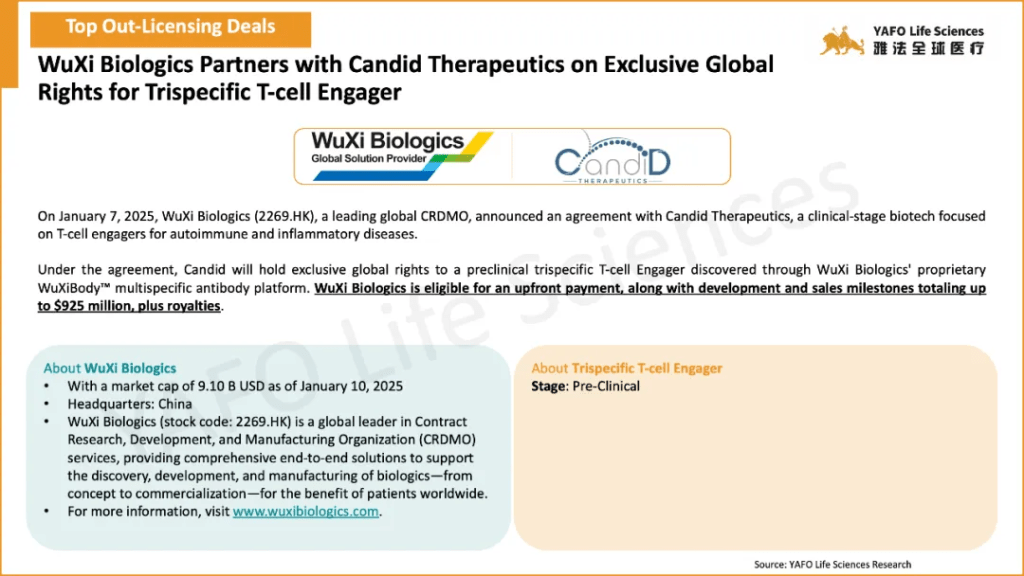

This week, the Chinese market has seen four significant out-licensing deals. Innovent has entered into a licensing agreement with Roche for the Phase I DLL3 ADC asset, with an upfront payment of $80 million and a total value of $1.08 billion. Sciwind has secured a licensing agreement with Verdiva Bio for its metabolic disease therapy portfolio, with an upfront payment of $70 million and a total deal value up to $2.4 billion. Duality has granted Avenzo an exclusive license for the EGFR/HER3 bispecific ADC, with an upfront payment of $50 million and a total value of $1.2 billion. Keymed has reached an exclusive licensing agreement for the CD38 mAb CM313 through the NewCo model, with an upfront payment of $30 million and a total value of $367.5 million.

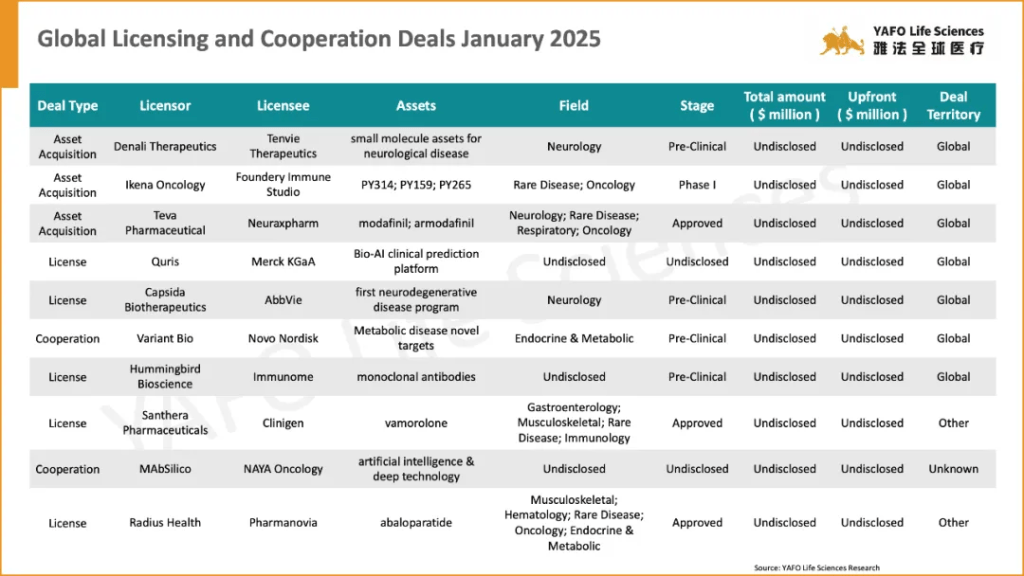

Globally, 21 additional licensing and cooperation deals were recorded. The highlight of the week was the expanded cooperation and investment deal between Valo Health and Novo Nordisk. Focused on developing novel treatments for cardiometabolic diseases, the agreement included near-term payments totaling up to $190 million.

2025年首周(1月1日-10日),全球医药市场共签署了37项资产授权和合作协议。中国市场共达成16项,包括9项出海交易、3项引进交易和4项国内交易。

本周中国市场重磅出海交易频出,达到4项。信达生物与罗氏就临床一期DLL3 ADC资产达成授权交易,首付款8000万美元,总价值10.8亿美元。先为达生物就代谢疾病产品组合与Verdiva Bio签署许可协议,首付款7000万美元,总价值24亿美元。映恩生物授予Avenzo EGFR/HER3 双抗ADC全球许可,首付款5000万美元,总价值12亿美元。康诺亚通过NewCo模式就CD38单抗CM313达成独家授权合作,首付款3000万美元,总价值3.675亿美元。

国际市场上,本周共签署了21项资产授权和合作协议。最大的一笔交易是诺和诺德与Valo Health就心血管代谢疾病创新疗法达成的扩大合作开发协议,近期付款最高可达1.9亿美元。

2. Licensing Deals

2a. China section

2b. Global section

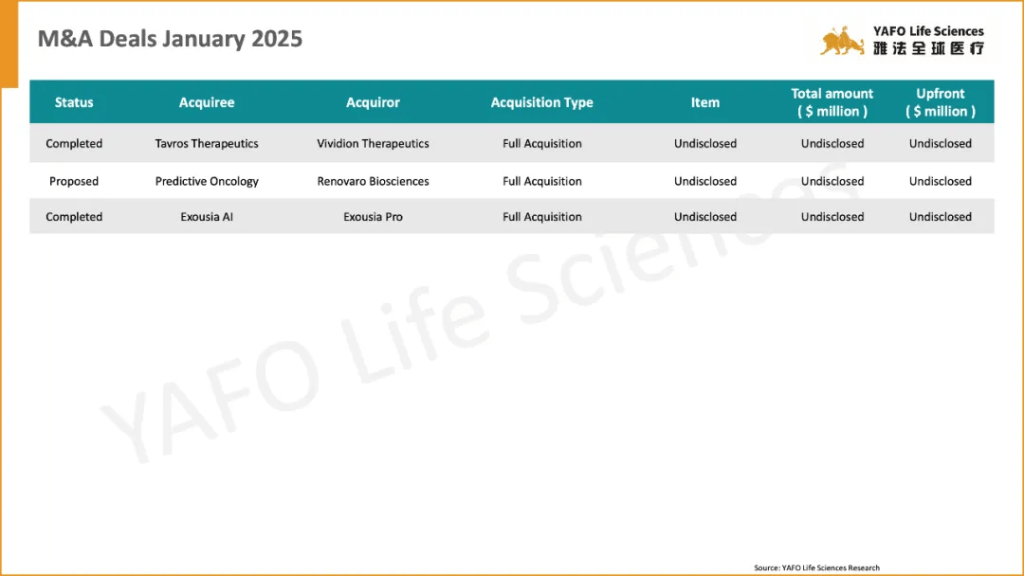

3. M&A Deals

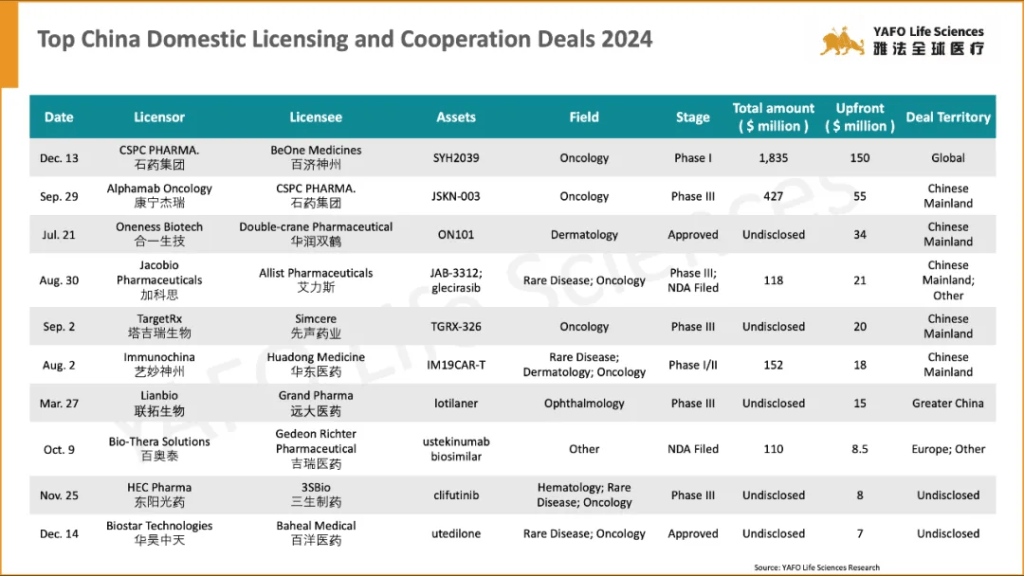

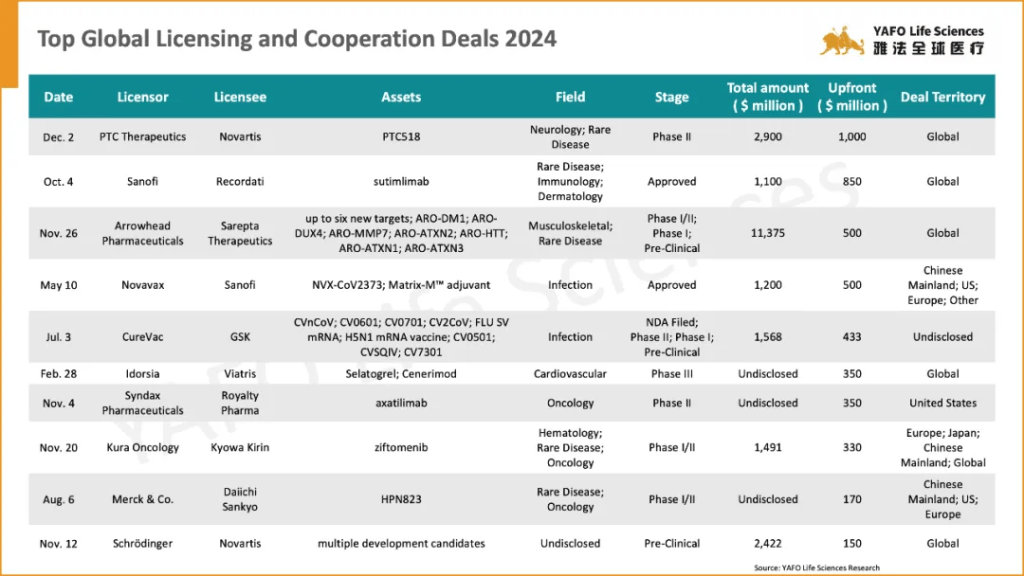

4. Top Deals of 2024

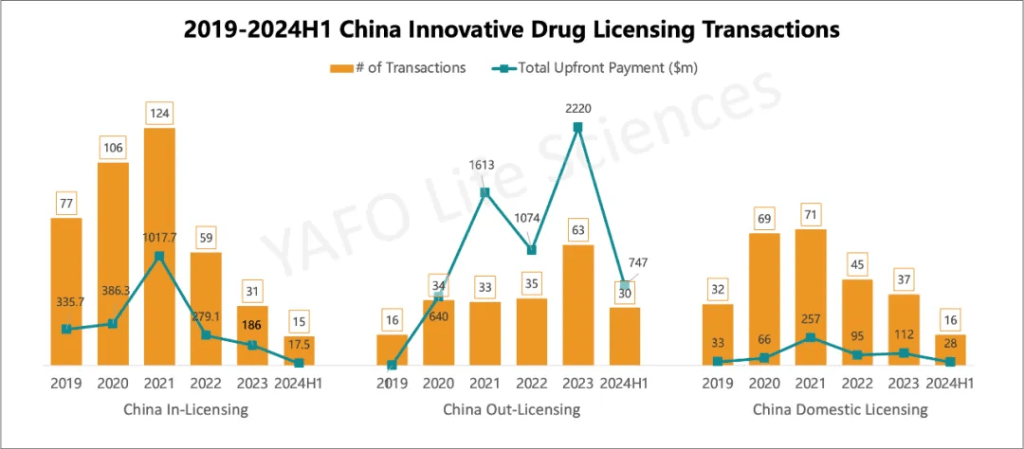

5. 2019-2023 China Innovative Drug Licensing Transactions

About YAFO CAPITAL

Founded in 2013, YAFO Capital is a Shanghai-based boutique investment and advisory firm, with a professional team in our China, U.S., EU, and SEA offices. Partnering with Pharmaceutical companies, YAFO Fund mainly invests in global assets. YAFO Life Sciences is a leading advisory boutique focused on asset transactions. YAFO has built a strong proven track record and closed dozens of in-licensing and out-licensing transactions with global pharma and biotech companies. Over the past five years, YAFO has been ranked as the No. 1 advisor for China cross-border licensing transactions. For more information, please visit http://www.yafocapital.com

雅法资本成立于2013年,作为新型投资和投行咨询机构,致力于中国及海外生物医药项目的投融资、资产跨境交易和资产孵化等。旗下雅法基金联合药企进行资产投资和并购,雅法全球医疗专注于医药产品跨境及国内授权交易。基于雅法在全球广泛的人脉与资源网络,在过去十年成功推进了大量的海外项目进入中国市场并协助多个中国产品完成海外授权。雅法拥有经验丰富的全球交易团队,覆盖美国、日本 、欧洲等全球主要医药创新区域。核心合伙人均为华尔街资深投行人士或具有跨国药企经历,为客户交易提供强力支持。雅法总部位于上海,在美国、欧洲、东南亚等地均设有分部。雅法在生物医药跨境授权及并购业务交易数量连续多年排名第一。

ACCESS CHINA

Event Name:

2025-01 药通中国论坛@JPM,线上&旧金山

2025-01 ACCESS CHINA @ JPM Week, Virtual & San Francisco