2025-05-27

1. Summary of the Week

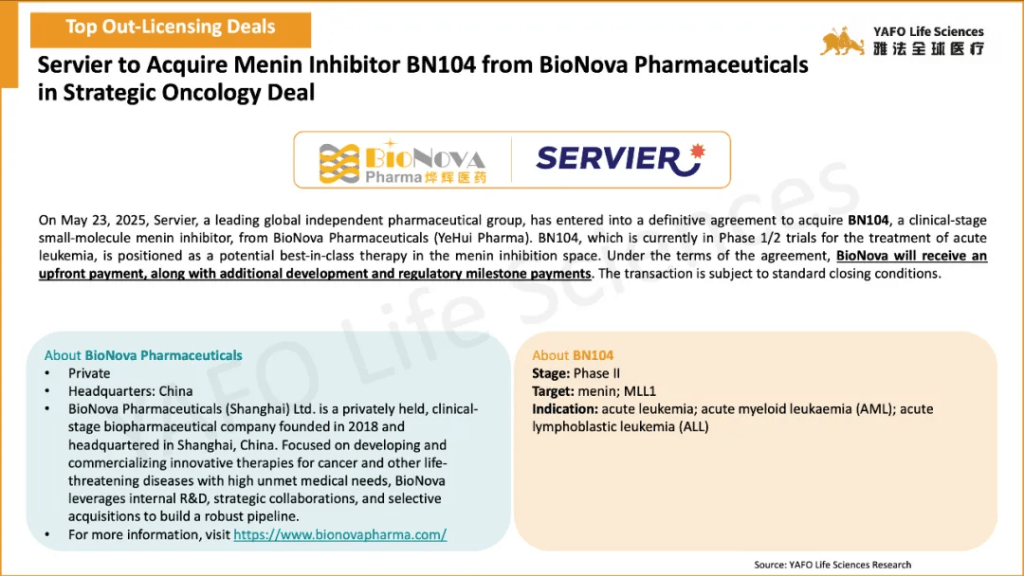

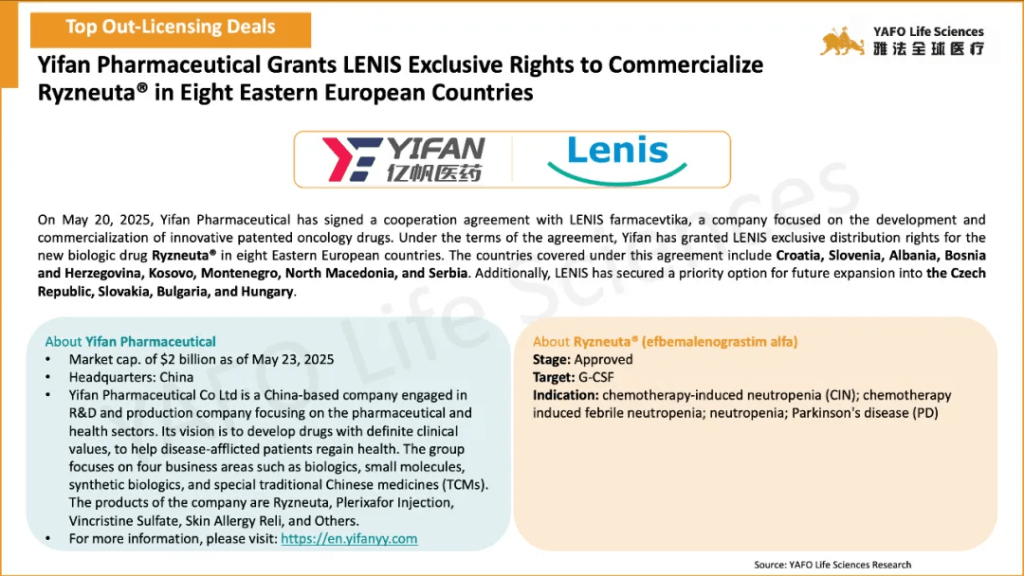

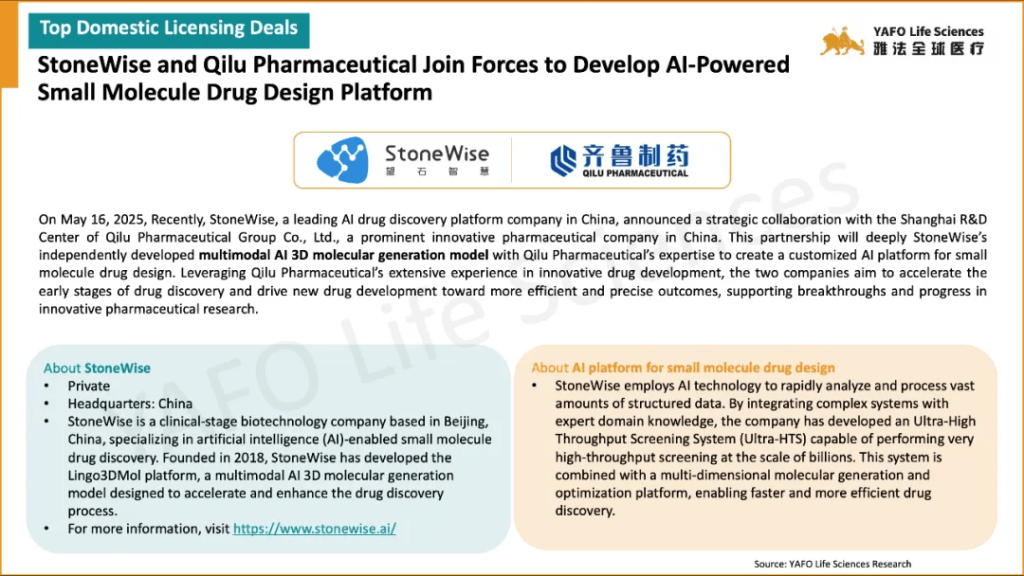

Between May 16 and 23, a total of 12 biopharmaceutical agreements were signed globally. Among them, six deals originated from China, including 4 out-licensing deals, 1 in-licensing deal, and 1 domestic collaboration.

The largest deal of the week was an out-licensing agreement involving 3SBio, GuojianPharmaceutical, and Pfizer, centered on the Phase III oncology asset SSGJ-707. The deal features an upfront payment of $1.25 billion and a total potential value of $6.15 billion.

On the global stage, six additional deals were announced. The most prominent was the partnership between Orionis Biosciences and Genentech for pre-clinical small-molecule monovalent glues. The deal includes an upfront payment of $105 million, with a total potential deal value of $2 billion.

2025年5月16-23日,全球医药市场共签署了12项资产授权和合作协议。中国市场共达成6项交易,包括4项出海交易、1项引进交易和1项国内交易。

本周最值得关注的交易是三生制药向辉瑞独家授予临床三期肿瘤资产PD-1/VEGF双特异性抗体SSGJ-707在全球(不包括中国内地)的权益,首付款12.5亿美元,创下了中国创新药资产出海交易的最高首付款记录,总金额也达到61.5亿美元。

国际市场上,本周共签署了6项资产授权和合作协议。价值最大的一项交易是Roche旗下公司Genentech与Orionis Biosciences就小分子单价分子胶药物的开发达成合作,首付款1.05亿美元,总金额20亿美元。

2. Licensing Deals

2a. China Section

2b. Global Section

3. M&A Deals

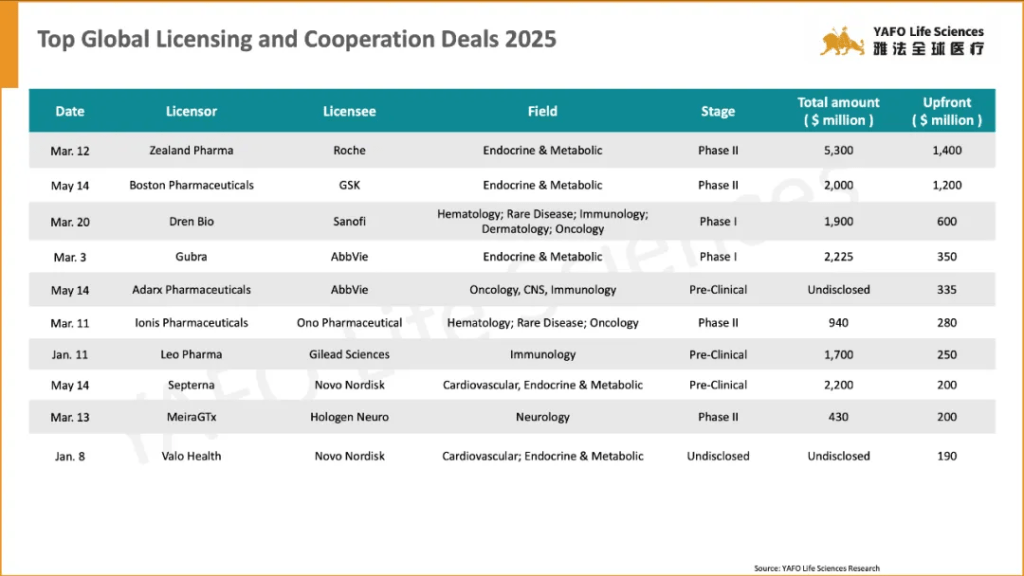

4. Top Deals of 2025

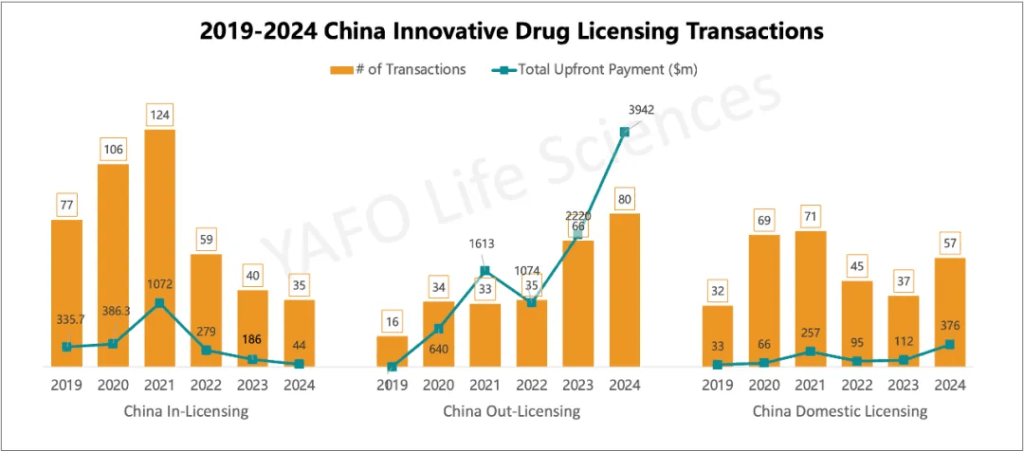

5. 2019-2024 China Innovative Drug Licensing Transactions

About YAFO Capital

Founded in 2013, YAFO Capital is a Shanghai based boutique investment and advisory firm, with professional team in our China, U.S., EU and SEA offices. Partnering with Pharmaceutical companies, YAFO Fund mainly invests in global assets. YAFO Life Sciences is a leading advisory boutique focused on asset transactions. YAFO has built a strong proven track record and closed dozens of in-licensing and out-licensing transactions with global pharma and biotech companies. Over the past five years, YAFO has been ranked as the No. 1 advisor for China cross border licensing transactions. For more information, please visit http://www.yafocapital.com

ACCESS CHINA

Event Name:

2025-06-15 ACCESS CHINA BD Forum @BIO, Virtual & Boston