2024-04-30

1. Executive Summary of the Month

In April, a total of 28 licensing and cooperation deals were signed globally. In the China Biotech Industry, 7 licensing and cooperation deals were specifically sealed: 1 out-licensing deal, 3 in-licensing deals, and 3 domestic deals. The highlight deal of the month is the domestic deal between Qyuns Therapeutics and Hansoh Pharmaceutical, amounting to $156 million with an upfront payment of $11 million.

On the global scale, there were a total of 21 global licensing and cooperation deals signed in April. The most prominent global deal was the deal between Arvinas and Novartis for Luxdegalutamide and AR-V7 PROTAC with a total deal value of $1,160 million and an upfront payment of $150 million.

2024年4月,全球医药市场共签署了28笔资产授权和合作协议,与3月份的40笔相比减少了30%。其中,中国医药市场共达成7笔交易,包括1笔出海交易、3笔引进交易和3笔国内交易。本月中国市场最重要的交易来自翰森制药与荃信生物达成的交易,首付款1100万美元,总价值1.56亿美元。

全球范围内,4月份共签署了21项资产授权和合作协议。最大的一笔交易是Novartis与Arvinas就两款靶向AR PROTAC达成的交易,首付款1.5亿美元,总价值11.6亿美元。

Target

Deal Size

Buyer

On Apr. 26th., Regeneron Pharmaceuticals and gene editing biotech Mammoth Biosciences announced a collaboration deal, which Regeneron will pay an upfront fee including $5 million in cash and $95 million in equity investment.

Mammoth, co-founded by Nobel laureate Jennifer Doudna, has a strong technological advantage in ultracompact gene editing platform. The traditional Cas9 system has about 1300 amino acids, making it very difficult to be fitted inside AAV. Mammoth’s system, on the other hand, has only 500 amino acids and can be fitted inside AAV, representing a significant advantage. In 2021, it completed a $150 million Series D financing and was valued at over $1 billion.

This deal may have been in the works since last year, as Regeneron hopes to leverage its strong antibody platform to improve the non-liver delivery efficiency of traditional gene editing technologies.

China’s overall academic capabilities in gene editing are very strong, and there are also biotechs like Castalysis Bioscience focusing on ultracompact gene editing platform. It is hoped that such deals could facilitate investment and internationalization in China’s gene editing field.

Peter Zhang

Partner, YAFO Capital

Target

Deal Size

Buyer

4月26日,美国Regeneron Pharmaceuticals与基因编辑公司Mammoth Biosciences达成合作,Regeneron将支付包括500万美金现金以及9500万美金股权投资在内的首付款。

作为由诺奖得主Jennifer Doudna联合成立的基因编辑公司,Mammoth在小编辑器上有极强的技术优势。传统cas9体系约有1300个氨基酸,导致AAV的包被非常困难;而Mammoth的系统只有500个氨基酸,可以被AAV包被,具有明显的优势。2021年公司完成了一笔1.5亿美金的D轮融资,估值更是超过了10亿美金。

这笔交易从去年开始就已经有一些端倪,再生元希望可以通过自身强大的抗体平台,提高传统基因编辑工具的非肝递送效率。

中国的基因编辑学术能力整体很强,也有例如篆码生物这样的专注于小编辑器的生物科技公司,希望这样的交易可以促进中国基因编辑领域的投资与国际化交易进度。

Peter Zhang

Partner, YAFO Capital

Target

Deal Size

Buyer

The most noteworthy deal in the life sciences this week is German instrument maker Bruker’s acquisition of US spatial omics company NanoString for $392 million.

Founded in 2003, NanoString was once a leader in the field of spatial transcriptomics. The company developed technologies such as GeoMx, which enabled high-resolution analysis of gene expression in tissue samples. These technologies made significant contributions to scientific research in fields such as cancer, immunology, and neuroscience.

However, NanoString lost a key patent lawsuit over its GeoMx product in 2023 and was ordered to pay 10X $31 million in damages. NanoString was unable to pay and filed for bankruptcy in February 2024. Its market value declined from once $3.7 billion to less than $7 million at the time of its bankruptcy.

Bruker has pledged to continue developing and supporting NanoString’s products. However, NanoString users have being accustomed to the company’s quick response and personalized support service. It remains to be seen whether Bruker can provide the same level of service.

NanoString being acquired also alarmed Chinese companies in the life sciences. Some Chinese companies have engaged in areas where NanoString is expertised, such as RNA detection, spatial omics, and single-cell multi-omics. They are gaining prominence in the global market with their strong R&D capabilities and understanding of the Chinese market.

Peter Zhang

Partner, YAFO Capital

Target

Deal Size

Buyer

本周生命科学领域最受关注的交易是德国仪器制造商Bruker以3.92亿美元收购美国空间组学公司NanoString。

NanoString成立于2003年,曾是空间转录组学领域的领军企业。该公司开发了GeoMx等技术,可以对组织样本中的基因表达进行高分辨率分析,为癌症、免疫学和神经科学等领域的科学研究做出了重大贡献。

然而,NanoString在2023年在一场针对其GeoMx产品的关键专利诉讼中败诉,被判向10X支付3100万美元赔偿金。公司无力偿还债务,于2024年2月申请破产,公司市值也从最高37亿美元跌至破产时的不到700万美元。

Bruker承诺将继续开发和支持NanoString的产品。然而,用户已经习惯了NanoString快速响应和个性化的支持服务,Bruker能否提供同等水平的服务还有待观察。

NanoString的被收购也为中国公司在生命科学领域的崛起敲响了警钟。RNA检测、空间组学和单细胞多组学等NanoString的优势领域均有多家中国公司布局,比如善准、华大基因和新格元等。这些公司正凭借其强大的研发能力和对中国市场的了解,在全球市场上崭露头角。

Peter Zhang

Partner, YAFO Capital

Target

Deal Size

Buyer

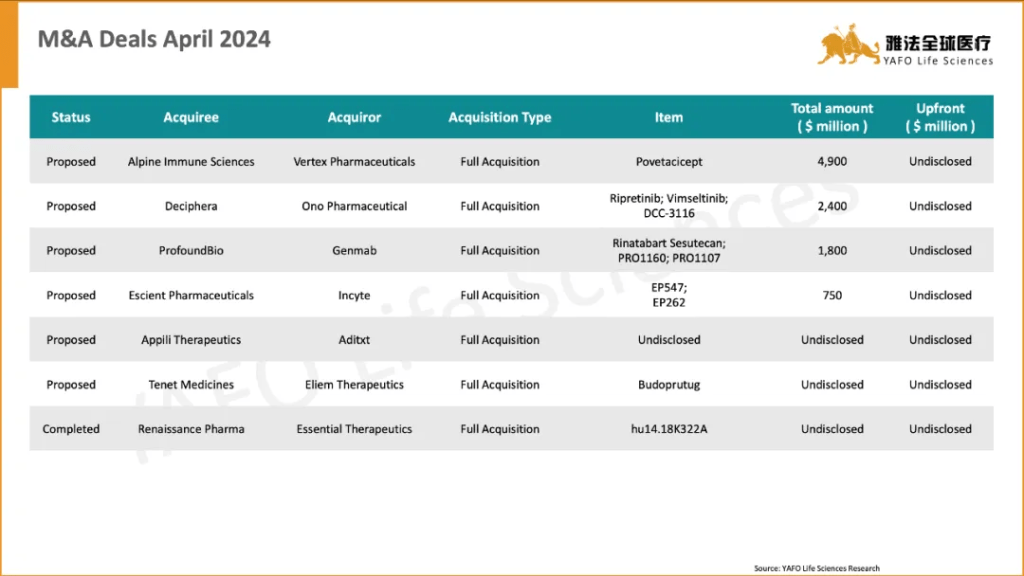

On April 10, Vertex Pharmaceuticals announced the acquisition of Alpine Immune, a clinical-stage biotechnology company focused on autoimmune diseases for $5 billion in cash, with over 66% transaction premium.

Vertex is one of America’s most legendary biopharmaceutical companies, whose history is detailed in the best-selling book “The Billion Dollar Molecule”. Under the leadership of current CEO Reshma Kewalramani, the company’s R&D strategy has been very steady, mostly relying on in-house and co-development, and has accumulated more than $10 billion cash on hand.

The main reason behind the acquisition is Alpine core asset, Povetacicept, a dual BAFF/APRIL antagonist. Research data demonstrate that it could reduce quantity and activity of B cells, hence having potential for various indications, including IgA nephropathy, SLE, thrombocytopenia, and etc.

Currently, autoimmune disease treatments against B-cell abnormalities are very hot in development. In addition to CD20 monoclonal antibodies and BTK inhibitors, cell therapies, allosteric inhibitors and others are also included.

Peter Zhang

Partner, YAFO Capital

Target

Deal Size

Buyer

4月10日,美国Vertex Pharmaceuticals宣布以50亿美元现金收购Alpine Immune, 一家处于临床阶段的自免疾病领域生物技术公司, 交易溢价超过66%。

Vertex是一家相当具有传奇色彩的美国生物制药公司, 其历史在畅销书《10亿美元分子》中有详细讲述。在现任CEO Reshma Kewalramani的带领下,该公司研发策略一直比较稳健,以自研以及联合开发为主,账上已经累计超过了100亿美元的现金。

本次收购交易的主要原因在于Alpine的核心资产Povetacicept,一种BAFF/APRIL双重拮抗剂。研究数据证实该药物可以有效降低B细胞的数量和活性,具有巨大的适应症潜力,包括IgA肾病、SLE、血小板减少症等。

目前,针对B细胞异常的自免药物开发非常火热。除了CD20单抗和 BTK抑制剂,还包括细胞疗法和变构抑制剂等方案。

Peter Zhang

Partner, YAFO Capital

2.Licensing Deals

2a. Out-Licensing Deals

2b. In-Licensing Deals

2c. Domestic Licensing Deals

3. 2019-2023 China Innovative Drug Licensing Transactions

About YAFO Capital

Founded in 2013, YAFO Capital is a Shanghai-based boutique investment and advisory firm, with a professional team in our China, U.S., and London offices. Partnering with Pharmaceutical companies, YAFO Fund mainly invests in global assets. YAFO Life Sciences is a leading advisory boutique focused on asset transactions. YAFO has built a strong proven track record and closed dozens of in-licensing and out-licensing transactions with global pharma and biotech companies. YAFO has been ranked as the No. 1 advisor for China cross-border licensing transactions in the past three years. For more information, please visit http://www.yafocapital.com

雅法资本成立于2013年,作为新型投资和投行咨询机构,致力于中国及海外生物医药项目的投资、融资服务、产品引进和资产孵化等。雅法在生物医药跨境授权及并购业务领域过往三年交易数量排名第一。旗下雅法基金联合药企进行资产投资和并购,雅法全球医疗专注于医药产品跨境及国内授权交易。基于雅法在全球广泛的人脉与资源网络,在过去十年成功推进了大量的海外项目进入中国市场并协助多个中国产品完成海外授权。雅法拥有经验丰富的全球交易团队,覆盖美国、日本 、欧洲等全球主要医药创新区域。核心合伙人均为华尔街资深投行人士或具有跨国药企经历,为客户交易提供强力支持。雅法总部位于上海,在伦敦、洛杉矶、东京、米兰、剑桥等地均设有分部。

ACCESS CHINA

Event Name: ACCESS CHINA Partnering Forum @BIO

Date & Time: June 3-20, 2024

Venue: San Diego & Online

Content: Keynote Speeches, Panel Discussion, Virtual Roadshows, Dinner Reception, 1X1 meetings

Scale: Expected 1000 participants Online, 150 participants onsite; 100 company roadshows

Participants: Pharma/Biotech senior management and BDs.

Registration Link: https://jinshuju.net/f/AqkB9m