2024-06-18

Target

Deal Size

Buyer

On June 13th, AbbVie made a $150 million upfront payment to FutureGen to introduce FG-M701, an antibody pipeline for treating IBD targeting TL1A. As a next-generation TL1A treatment solution, it offers better therapeutic efficacy and dosing frequency, and has the potential to become a Best-in-Class (BIC).

TL1A, a very hot target over the past two years, saw Merck acquired Prometheus for $10.8 billion in 2023, while Roche introduced a TL1A pipeline incubated by Roivant for $7.1 billion. It is worth noting that TL1A is not the leading pipeline of FutureGen, and it is expected to enter clinical trials this year.

AbbVie, with Humira, has a significant advantage in the IBD field. This transaction will be its strategy to cope with the patent cliff of Humira in IBD. Compared to TNFα, TL1A has higher specificity for IBD diseases. In addition to this target, others including RIPK1, SMAD7, Toll-like receptors, and microbiome therapies could potentially disrupt the current standard of care (SoC) in this field.

Peter Zhang

Partner, YAFO Capital

Target

Deal Size

Buyer

6月13日,艾伯维以1.5亿美金的首付款从明济生物(FutureGen)引进了FG-M701, 一款治疗IBD的TL1A抗体管线。作为下一代TL1A治疗方案,该管线有着更好的疗效以及给药频次,有成为BIC的潜在可能。

TL1A作为过去两年非常火热的靶点,Merck在2023年以108亿美金并购了Promethus, 罗氏则是以71亿美金的价格引进了Roivant孵化的一款TL1A管线。值得注意的是,TL1A并不是明济最成熟的管线,FG-M701预计今年将进入临床试验。

艾伯维坐拥修美乐,在IBD领域有着巨大优势,这个交易将是其应对修美乐进入专利悬崖后对IBD的应对策略。对比TNFα, TL1A对IBD疾病的特异性更强。除了该靶点,包括RIPK1, SMAD7, TOLL样受体等靶点,微生物治疗等不同方案都有可能颠覆该领域的SoC。

Peter Zhang

Partner, YAFO Capital

1. Summary of the week

6月7日-14日,全球共达成11项资产授权与合作交易。中国医药市场共达成3项交易,包括2项出海交易和1项国内交易。艾伯维和明济生物之间就后者一临床前资产达成授权交易,首付款1.5亿美元,总金额17.1亿美元。武田制药与亚盛医药签署奥雷巴替尼独家许可选择权协议,总金额13亿美元。丽珠制药与轩竹生物就后者PDE5抑制剂复达那非达成独家授权许可合作。

国际市场上,共签署了8项资产授权与合作交易。其中最值得关注的交易是GSK与Ochre Bio之间签署的多年数据许可协议,总金额3750万美元。

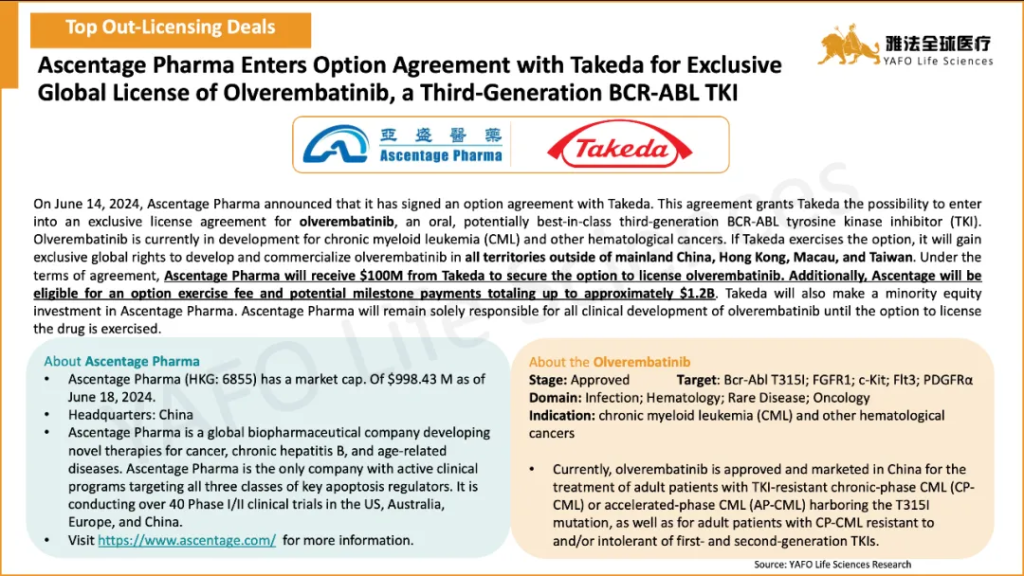

From June 7 to 14, a total of 11 licensing and cooperation deals were signed globally. In the China Biotech Industry, there were 2 out-licensing deal and 1 domestic licensing deal. Futuregen Biopharm signed an out-licensing deal with AbbVie for a pre-clinical stage asset, amounting to a total deal of $1.71 billion, with an upfront payment of $150 million. Ascentage Pharma signed a $1.3 Billion out-licensing agreement with Takeda Pharmaceuticals for Olverembatinib. Meanwhile, Xuanzhu Biopharm and Livzon Pharmaceutical signed a domestic licensing deal for Fadanafil.

Globally, there were 8 other licensing and cooperation deals signed. The highlight deal of the week was the licensing agreement between Ochre Bio and GSK, amounting to a total of $37.5 million.

2. Licensing Deals

2a. China section

2b. Global section

3. Top Deals of the year 2024

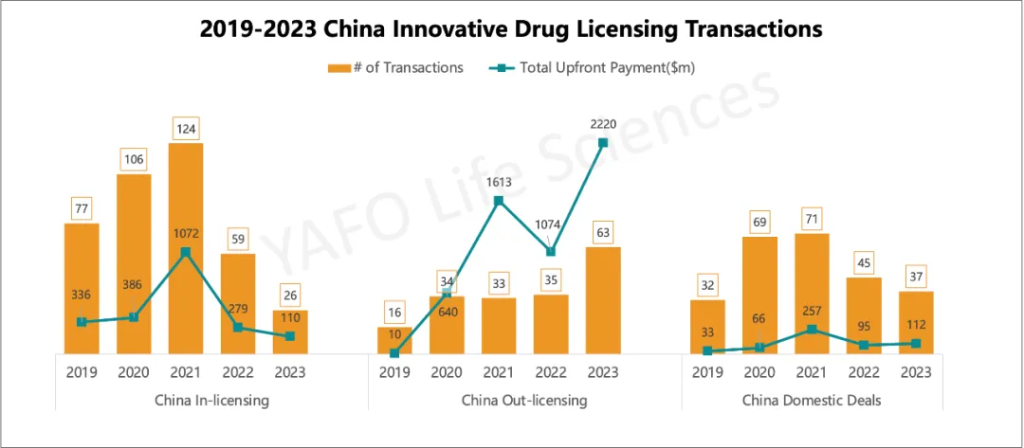

4. 2019-2023 China Innovative Drug Licensing Transactions

About YAFO Capital

Founded in 2013, YAFO Capital is a Shanghai based boutique investment and advisory firm, with professional team in our China, U.S., and London offices. Partnering with Pharmaceutical companies, YAFO Fund mainly invests in global assets. YAFO Life Sciences is a leading advisory boutique focused on asset transactions. YAFO has built a strong proven track record and closed dozens of in-licensing and out-licensing transactions with global pharma and biotech companies. YAFO has been ranked as the No. 1 advisor for China cross border licensing transactions in the past three years. For more information, please visit http://www.yafocapital.com

雅法资本成立于2013年,作为新型投资和投行咨询机构,致力于中国及海外生物医药项目的投资、融资服务、产品引进和资产孵化等。雅法在生物医药跨境授权及并购业务领域过往三年交易数量排名第一。旗下雅法基金联合药企进行资产投资和并购,雅法全球医疗专注于医药产品跨境及国内授权交易。基于雅法在全球广泛的人脉与资源网络,在过去十年成功推进了大量的海外项目进入中国市场并协助多个中国产品完成海外授权。雅法拥有经验丰富的全球交易团队,覆盖美国、日本 、欧洲等全球主要医药创新区域。核心合伙人均为华尔街资深投行人士或具有跨国药企经历,为客户交易提供强力支持。雅法总部位于上海,在伦敦、洛杉矶、东京、米兰、剑桥等地均设有分部。

ACCESS CHINA

Event Name: ACCESS CHINA Networking & Gathering @BIO

Date & Time: June 2-6, 2024

Venue: San Diego

Content: Reception, 1X1 meetings

Participants: Pharma/Biotech senior management and BDs.

Registration Link: https://jinshuju.net/f/AqkB9m?x_field_1=BIO