1. Summary of the Week

2025年9月6日-12日,全球医药市场共签署了10项资产授权和合作协议。中国市场共达成2项交易,均为国内交易。

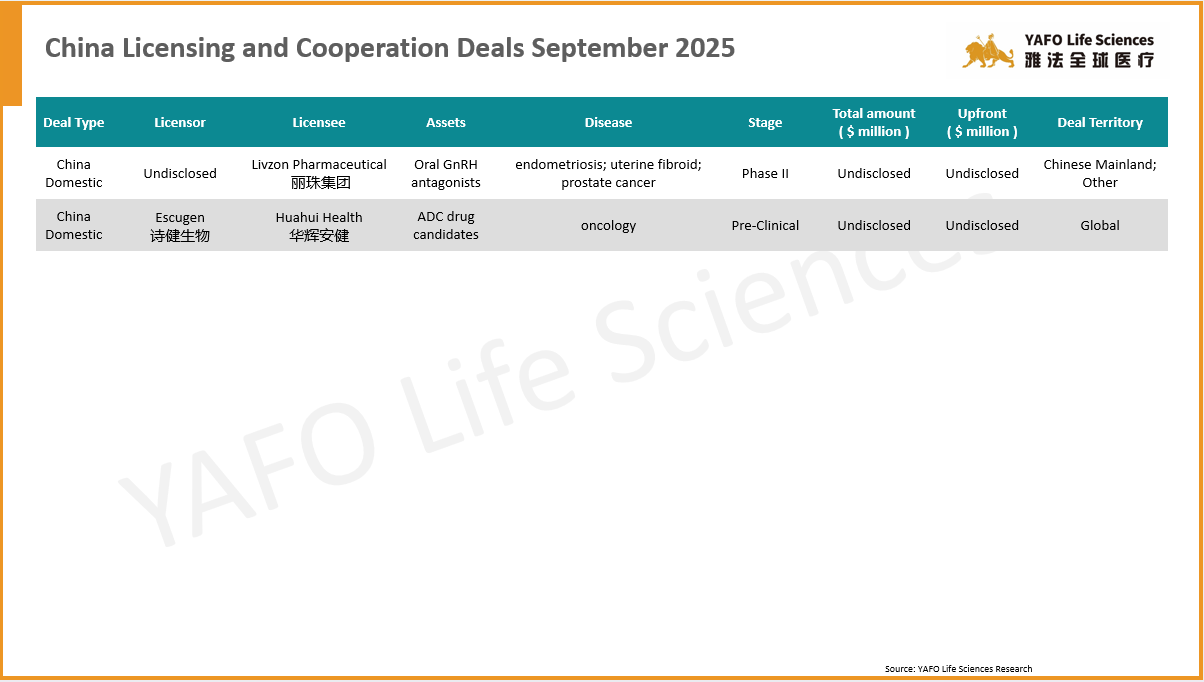

国内市场上,本周的两项国内交易分别是丽珠制药引进一款新型口服GnRH拮抗剂,以及诗健生物与华辉安健就新一代靶点ADC 药物达成全球战略合作。

国际市场上,本周共签署了8项资产授权和合作协议。最大的一项交易是Servier从Kaerus Bioscience引进一款临床1/2期资产KER-0193,总金额可达4.5亿美元。

From September 6 to 12, a total of 10 agreements were signed globally. Within the China biotech industry, there were two domestic deals.

In China, the two domestic deals were LIVZON Pharmaceutical’s in-licensing of a novel oral GnRH antagonist and the global strategic partnership between Escugen and Huahui Health for next-generation targeted ADC therapies.

Globally, 8 deals were announced. The top global deal of the week was signed between Kaerus Bioscience and Servier for the Phase I/II asset KER-0193, with a total deal value of $450 million.

2. Licensing Deals

2a. China Section

2b. Global section

3. M&A Deals

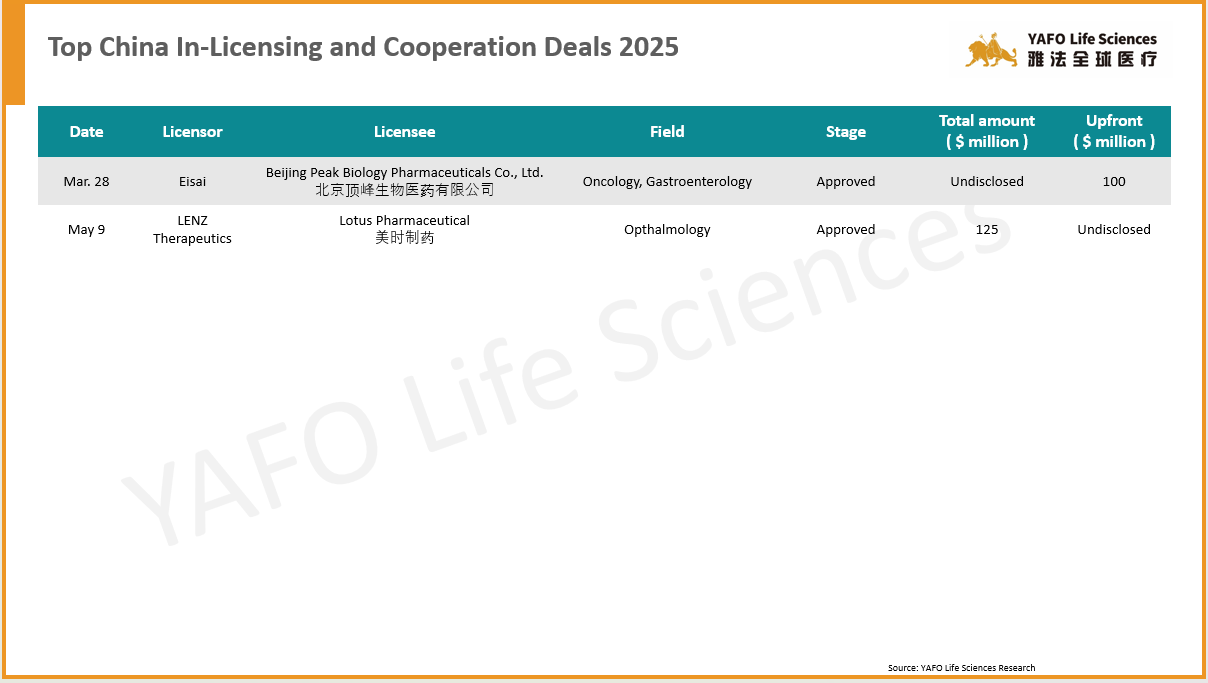

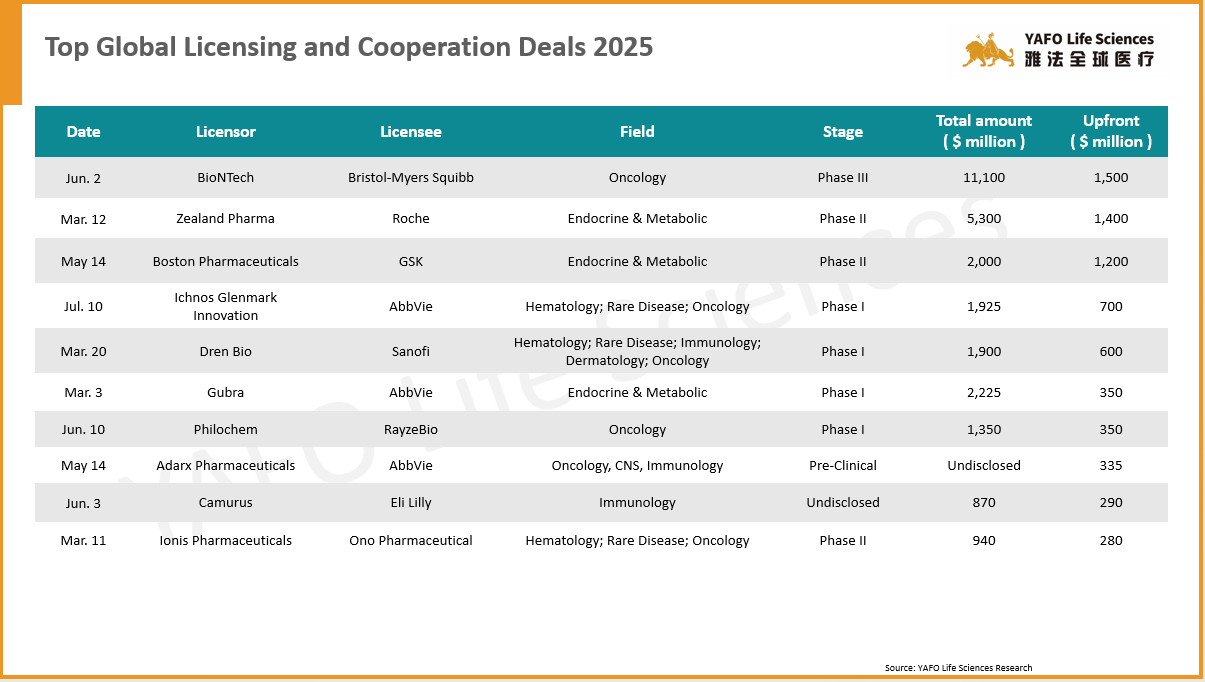

4. Top Deals of 2025

5. 2019-2024 China Innovative Drug Licensing Transactions

About YAFO Capital

Founded in 2013, YAFO Capital is a Shanghai-based boutique investment and advisory firm, with a professional team in our China, U.S., EU, and SEA offices. Partnering with Pharmaceutical companies, YAFO Fund mainly invests in global assets. YAFO Life Sciences is a leading advisory boutique focused on asset transactions. YAFO has built a strong, proven track record and closed dozens of in-licensing and out-licensing transactions with global pharma and biotech companies. Over the past five years, YAFO has been ranked as the No. 1 advisor for China cross-border licensing transactions. For more information, please visit http://www.yafocapital.com

雅法资本成立于2013年,作为新型投资和投行咨询机构,致力于中国及海外生物医药项目的投融资、资产跨境交易和资产孵化等。旗下雅法基金联合药企进行资产投资和并购,雅法全球医疗专注于医药产品跨境及国内授权交易。基于雅法在全球广泛的人脉与资源网络,在过去十年成功推进了大量的海外项目进入中国市场并协助多个中国产品完成海外授权。雅法拥有经验丰富的全球交易团队,覆盖美国、日本 、欧洲等全球主要医药创新区域。核心合伙人均为华尔街资深投行人士或具有跨国药企经历,为客户交易提供强力支持。雅法总部位于上海,在美国、欧洲、东南亚等地均设有分部。雅法在生物医药跨境授权及并购业务交易数量连续多年排名第一。